Green Tax in Maharashtra is charged on old vehicles to reduce pollution. Ministry of Road Transport and Highways applies this tax on vehicles that cause more pollution. If your commercial vehicle is more than 8 years old, you must pay Green Tax. If your private vehicle is more than 15 years old, you also need to pay Green tax. If you want to pay Green Tax for your car or bike in Maharashtra, you should first understand payment process. In this blog, you will learn how to pay Green Tax online in Maharashtra.

RTO green tax online Maharashtra

The state government imposes green tax to control increasing levels of pollution. It mainly discourages use of older or highly polluting vehicles due to high tax.

Rates of Green tax in Maharashtra

The green taxes on various vehicles in Maharashtra are as follows:

| Vehicle Category(age criteria) | Green Tax Applicable |

| Two-wheelers(5 yrs) | Rs 2000 |

| Diesel vehicles(5 yrs) | Rs 3500 |

| Petrol vehicles(5 yrs) | Rs 3000 |

| Autorickshaws(5 yrs) | Rs 750 |

| Light good vehicles(5 yrs) | Rs 2500 |

| Six-seater taxis | Rs 1250 |

| Vehicles having more than 7500 kg capacity | 10% of annual tax |

| Service vehicles | 2.5% of annual tax |

| Contract buses | 2.5% of annual tax |

| Tourist buses | 2.5% of annual tax |

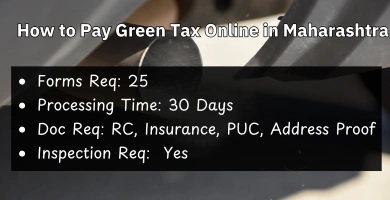

How to pay green tax online in Maharashtra

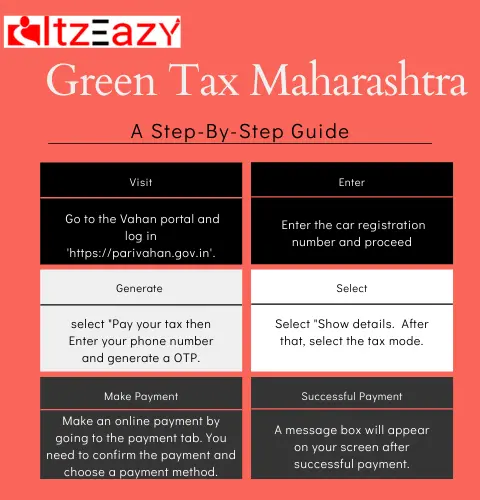

Steps to pay green tax online in Maharashtra are as follows:

- Visit the ‘Parivahan‘

- Select Vehicle Related Services.

- Choose Maharashtra as state and RTO

- Click on Pay your Tax

- Enter your vehicle registration number and last 5 digits of the chassis number

- Select “Show details” from the drop-down menu

- Select the tax payment mode

- Make an online payment

- Confirm the payment and choose a payment method

You can pay green tax for car in Mumbai or Pune using the above steps only. Also, you can follow same process to pay green tax for bike in Maharashtra.

How to download green tax Maharashtra receipt

After paying green tax online in Maharashtra? Here is how to download green tax receipt from parivahan.

- To download the green tax receipt, go to Vahan Parivahan

- After logging in successfully, hover your mouse over “Status” and select “Reprint E-Receipt/Forms”

- Select your Application Type, enter your Registration Number and Chassis Number, and then click Submit

- Choose the Transaction Number for which you wish to reprint the E-Receipt/Form

- Click “Print” to print the information

What does Green Tax mean in India

Old vehicles release smoke and harmful gases. This increases air pollution. Heavy trucks that carry goods also add more smoke to air. To reduce pollution, Government of India has introduced Green Tax.

You must pay Green Tax if you own old vehicle. Both private and commercial vehicles are included. Tax amount is different in every state and depends on type of vehicle. Vehicles registered in highly polluted cities like Delhi have to pay higher tax. Only petrol and diesel vehicles need to pay Green Tax.

The money raised from the green tax are being used by the government to build infrastructure to track emissions. Main aim of this tax is to encourage you to switch to cleaner and less polluting vehicles.

In India, there is a green vehicle tax

If your commercial vehicle is more than 8 years old, you must pay Green Tax when you renew fitness certificate. You may have to pay 10% to 25% of road tax as Green Tax. After 15 years, personal automobiles must pay a green tax at time of RC renewal. In this case, Green Tax can go up to 50% of road tax, especially in highly polluted cities. Green Tax amount is different in every state.

Benefits of Green Tax

- Government has imposed a green tax in order to lower pollution levels in the environment.

- Main purpose of Green Tax is to encourage you to switch to new vehicles and make you aware that old vehicle emissions harm environment.

- Government will use Green Tax money to control pollution and set up new facilities to monitor pollution levels.

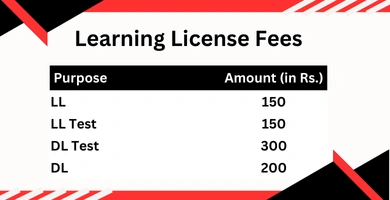

Two wheeler license fees in Maharashtra

FAQs

Which fuel type of vehicle does not need to pay green tax in India?

Green tax does not apply to electric vehicles or vehicles that run on CNG or ethanol. The vehicles that run on diesel or petrol need to pay green tax in India.

Is the green tax mandatory in India?

Yes, if your vehicle runs on petrol or diesel, you must pay Green Tax. Tax amount depends on state and type of vehicle.

Can I pay green tax online in Maharashtra?

Yes, you can pay green tax online in Maharashtra through vahan parivahan website.

Is Green Tax refundable?

No. Green Tax is non-refundable.

How much charges for green tax in Maharashtra?

In Maharashtra, Green Tax for two-wheelers for 5 years is Rs 2000. For diesel vehicles for 5 years, you need to pay Rs 3500. For petrol vehicles for 5 years, fee is Rs 3000. Green tax for autorickshaws for 5 years is Rs 750 and for light goods vehicles for 5 years is Rs 2500.

What happens if I don’t pay Green Tax?

If you do not pay Green Tax, your RC renewal or fitness certificate will not be processed. You may also have to pay fine for missing documents.

Does every 15-year-old vehicle have to pay Green Tax?

Yes, any private vehicle completing 15 years must pay Green Tax at the time of renewal.

sundeep

How to pay green tax online in state of maharastara

Sandip Sakhare

How to pay green tax at Nagpur for two wheeler

Pravin Bhuruk

Green tax paid

Pravin Bhuruk

MH12cd3771 green tax paid

Suraj

what is the procedure to extend the 4 wheel vehicle

Ramesh Ayaldar

Green tax payment

Ravindra

Is it necessary physical checkup of the bike what is the procedure for that

Adi

This is good! Followed the EAZY steps and paid the green tax for my superbike. Its 2000. Beware of agents asking for 40000 for superbike green tax renewals. Greedy souls.

Deepti T

please share the details how to apply

AMIT RAVI SHARMA

Presantly i live in Goa n my I want to pay green tax for my swift car online 3000rs…. Do I need to take my car to Mumbai Thane RTo office as the number belongs to Mumbai thane.

Sumeet Sarkar

You can pay it via parivahan website by selecting your RTO

CHETAN SUDHAKAR KINI

for greentax paid

PRADEEP

I HAVE A LPG/ PETROL CAR, IS GREEN TAX APPLICABLE FOR THIS?