Green tax in Maharashtra is an essential initiative aimed at reducing vehicular pollution and promoting a cleaner environment. If you are looking to pay the green tax for your car or bike in Maharashtra ,you should know the applicable charges and payment process for it. The blog will cover the steps to pay green tax online in Maharashtra and provide details on green tax charges.

The Ministry of Road Transport and Highways imposes a green tax on older vehicles that are likely to cause environmental pollution. It needs to pay for commercial vehicles older than 8 years and private vehicles older than 15 years.

RTO green tax online Maharashtra

The state government imposes a green tax to combat increasing levels of pollution. It mainly discourages the use of older or highly polluting vehicles due to high tax.

Rates of Green tax in Maharashtra

The green taxes on various vehicles in Maharashtra are as follows:

| Vehicle Category(age criteria) | Green Tax Applicable |

| Two-wheelers(5 yrs) | Rs 2000 |

| Diesel vehicles(5 yrs) | Rs 3500 |

| Petrol vehicles(5 yrs) | Rs 3000 |

| Autorickshaws(5 yrs) | Rs 750 |

| Light good vehicles(5 yrs) | Rs 2500 |

| Six-seater taxis | Rs 1250 |

| Vehicles having more than 7500 kg capacity | 10% of annual tax |

| Service vehicles | 2.5% of annual tax |

| Contract buses | 2.5% of annual tax |

| Tourist buses | 2.5% of annual tax |

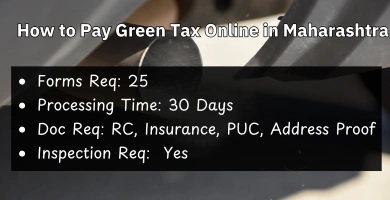

How to pay green tax online in Maharashtra

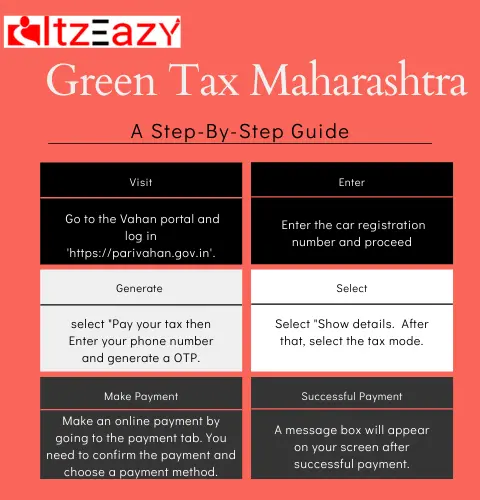

Steps to pay green tax online in Maharashtra are as follows:

- Visit the ‘Parivahan‘

- Select Vehicle Related Services.

- Choose Maharashtra as state and RTO

- Click on Pay your Tax

- Enter your vehicle registration number and last 5 digits of the chassis number

- Select “Show details” from the drop-down menu

- Select the tax payment mode

- Make an online payment

- Confirm the payment and choose a payment method

You can pay green tax for car in Mumbai or Pune using the above steps only. Also same process ,you can follow to pay green tax for bike in Maharashtra.

How to download green tax Maharashtra receipt

After paying green tax online in Maharashtra? Here is how to download green tax receipt from parivahan.

- To download the green tax receipt, go to Vahan Parivahan

- After logging in successfully, hover your mouse over “Status” and select “Reprint E-Receipt/Forms”

- Select your Application Type, enter your Registration Number and Chassis Number, and then click Submit

- Choose the Transaction Number for which you wish to reprint the E-Receipt/Form

- Click “Print” to print the information

What does Green Tax mean in India

- Older automobiles in the country are subject to a green tax, as the emissions from their engines pollute the environment. As a result, vehicle owners must pay a particular tax amount known as “Green tax” for their old vehicles.

- Old automobiles that produce gases or smoke have a significant negative influence on the environment and contribute significantly to pollution. Smoke levels in the air are also increased by heavy vehicles transporting products from one location to another. As a result, it is critical to restrict the use of older vehicles, for which the Indian government has imposed a Green tax.

- Both commercial and personal automobiles are subject to this tax. The amount of green tax paid varies from state to state and is also dependent on the type of vehicle.

- Vehicles registered in severely polluting cities, like Delhi, would face a higher green fee.

- To preserve the environment from pollution, a green tax is imposed only on gasoline and diesel cars.

The money raised from the green tax are being used by the government to build infrastructure to track emissions. The country’s citizens should be encouraged to shift to less polluting automobiles as a result of the green tax.

In India, there is a green vehicle tax

Commercial vehicles that are more than 8 years old are required to pay a ‘Green tax’ when their fitness certificates are renewed. They will be charged between ten and twenty-five percent of the road tax. After 15 years, personal automobiles must pay a green tax while renewing their registration certification. In this instance, the green fee can be up to 50% of the road charge, especially in polluted cities. As a result, the green tax differs from one state to another.

Benefits of Green Tax

- Government has imposed a green tax in order to lower pollution levels in the environment.

- The purpose of enacting the green tax is to encourage citizens to convert to new vehicles and to educate them about how existing vehicle emissions have a negative influence on the environment.

- The Green tax revenue will be used by the government to monitor pollution levels and new facilities will be established to keep track of it.

Two wheeler license fees in Maharashtra

FAQs

Which fuel type of vehicle does not need to pay green tax in India?

The green tax does not apply to electric vehicles or vehicles that run on CNG or ethanol. The vehicles that run on diesel or petrol need to pay green tax in India.

Is the green tax mandatory in India?

Yes, vehicles that run on petrol or diesel need to pay a green tax. The tax rates vary across states on the basis of vehicle type.

Can I pay green tax online in Maharashtra?

Yes, you can pay green tax online in Maharashtra through vahan parivahan website.

Is Green Tax refundable?

No. Green Tax is non-refundable.

How much charges for green tax in Maharashtra?

- Two-wheelers(5 yrs) -Rs 2000

- Diesel vehicles(5 yrs)- Rs 3500

- Petrol vehicles(5 yrs) -Rs 3000

- Autorickshaws(5 yrs) -Rs 750

- Light good vehicles(5 yrs) -Rs 2500

What happens if I don’t pay Green Tax?

If you do not pay green tax, your RC renewal or fitness certificate will not be processed , You may have to face fine due to non availability of documents.

Does every 15-year-old vehicle have to pay Green Tax?

Yes. Any private vehicle completing 15 years must pay Green Tax at the time of renewal.

sundeep

How to pay green tax online in state of maharastara

Sandip Sakhare

How to pay green tax at Nagpur for two wheeler

Pravin Bhuruk

Green tax paid

Pravin Bhuruk

MH12cd3771 green tax paid

Suraj

what is the procedure to extend the 4 wheel vehicle

Ramesh Ayaldar

Green tax payment

Ravindra

Is it necessary physical checkup of the bike what is the procedure for that

Adi

This is good! Followed the EAZY steps and paid the green tax for my superbike. Its 2000. Beware of agents asking for 40000 for superbike green tax renewals. Greedy souls.

Deepti T

please share the details how to apply

AMIT RAVI SHARMA

Presantly i live in Goa n my I want to pay green tax for my swift car online 3000rs…. Do I need to take my car to Mumbai Thane RTo office as the number belongs to Mumbai thane.

Sumeet Sarkar

You can pay it via parivahan website by selecting your RTO

CHETAN SUDHAKAR KINI

for greentax paid

PRADEEP

I HAVE A LPG/ PETROL CAR, IS GREEN TAX APPLICABLE FOR THIS?