Citizen Services

Driving Lessons

Campus (Coming Soon!)

Last updated: February 15, 2026

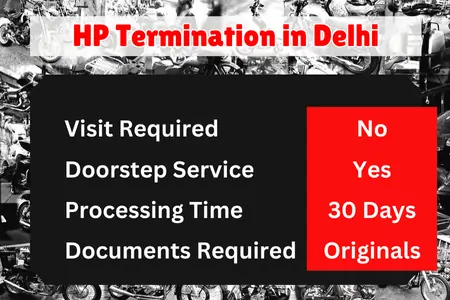

Processing time - 30 days

Itzeazy takes care of the entire process of HP termination in Bangalore i.e.

Over View

Process

Document Required

FAQ's

Yes, its mandatory to clear the loan and do hypothecation termination before selling the car. Without clearing hypothecation in Delhi RTO you can not apply for RC transfer process.

Either you can repay complete loan and remove hypothecation or loan continuation letter can be taken from the bank .

No. Hypothecation is not removed automatically. Bank issues NOC certificate and form 35 set for vehicle loan closure. Application for hypothecation removal should be submitted in the concerned RTO for HP termination from the RTO record.

The status of hypothecation can be checked from Parivahan website . If vehicle has a loan it would be shown as financed from the bank.

No. Form 35 and NOC are not the same . NOC is given by the financer once you repay the loan on vehicle completely. It is stated in the NOC that loan has been closed and bank has no objection in the removal of hypothecation from the RTO record against the said vehicle.

Form 35 is the RTO application form used for the hypothecation termination from the RTO record of the vehicle.2 sets of form 35 is to be submitted in the RTO for hypothecation cancellation along with supporting documents. This form 35 should be signed by both bank as well as registered owner.

If the bank from which you had taken loan has been merged with new bank, in that scenario you should contact new bank. The new bank will issue bank NOC and form 35.

You must apply for hypothecation termination at the RTO office in Delhi where your vehicle is registered.

You can change address on your RC While applying for hypothecation termination. You should apply for hypothecation termination with change of address.

Following are the documents required for hypothecation termination with address change :

Ownership is still shown under the bank/financer:

Your RC (Registration Certificate) will continue to show the financer (bank/NBFC) as the vehicle’s legal owner.

Even if you've repaid the loan, the vehicle isn’t fully yours on record until hypothecation is removed.

You cannot sell or transfer the vehicle:

Selling the vehicle requires a clear RC. Hypothecation must be removed before ownership can be transferred to a buyer.

You may face legal/insurance complications:

In case of accidents, insurance claims might get complicated since the financier is still listed.

Some insurers may deny full claim or settlement if hypothecation details are outdated.

Vehicle NOC cannot be issued:

If you plan to shift to another state or RTO, the RTO will not issue a No Objection Certificate (NOC) until hypothecation is removed.

Delays in re-registration or scrapping:

If you want to re-register the vehicle in another state or get a vehicle scrapped, a clean RC is required.

Challans or notices may still go to the bank:

In some cases, traffic or legal notices might still be directed to the registered owner (bank), causing confusion or delay.

Yes, you will get new RC after hypothecation removal in Delhi. You need to submit original RC in the RTO along with supporting documents to terminate hypothecation. New RC is issued, after processing is done in the RTO.

You can get NOC from bank online. However please note that to remove hypothecation from RC in the RTO you need to submit original hard copy of the bank NOC signed and stamped by the bank along with supporting documents.

So get the original bank NOC and form 35 from the bank.

If a vehicle is purchased on loan from a financier the same could be endorsed in the RTO record of RC. Application for hypothecation should be submitted to the RTO in Delhi where vehicle is registered.

Following are the documents required for HP addition in Delhi:

Vehicle hypothecation from RTO can not be done with soft copy of bank NOC and form 35. Original bank NOC and form 35 is required to apply for hypothecation termination in the RTO. Please contact your bank and get the physical copy of bank NOC and form 35 having original seal and sign of the bank on it. After this you need to submit application for hypothecation termination in the RTO where vehicle is originally registered.

Yes, you will get new RC after hypothecation removal in Delhi. You need to submit original RC in the RTO along with supporting documents to remove hypothecation from RTO. New RC is issued, once process is done in the RTO.