In the article, we will take a look at company formation, limited liability company, Private limited company and Public limited company. Ministry of Corporate Affair aka MCA is a government entity of India where company registration in India is done through the registrar of companies. This is the place where every kind of company is a registered private limited company, limited liability company etc. Although, company formation or procedure for incorporation of a company is quite easy first, let us understand what type of business registration you want to do and what your capital investment is.

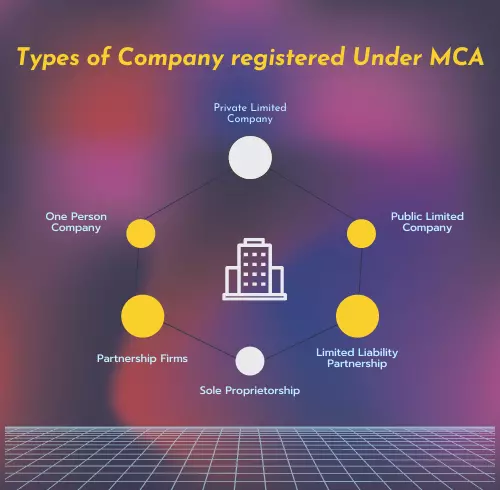

Starting a company formation or doing its own business is a dream of many Indians, and being registered on the MCA makes a big deal. First, let us know the types of companies in India that can be registered on MCA.

Types of companies registered in MCA according to liability and ownership

Private limited company

Private limited company formation – A company falls under private limited company when it has the following features

- Owned by a private owner

- Shareholders cannot transfer their shares

- Have 2 members or 2 directors minimum and 50 to 200 members maximum

- Every shareholder is responsible for his share capital

- The public cannot donate to its share capital

- Minimum paid-up capital is 1 Lakhs and maximum extended time to time

The Pvt. Ltd company formation or a registration in the Ministry of Corporate Affairs can be done as limited by share or limited by Guarantee. Most people prefer a company limited by shares because of the ideal legal structure and profit.

Private Limited Company Registration

Limited by Share Company

Company formation limited by share- The general form of a company in India is a company limited by share because it offers limited liability. Private or public companies can be limited company by share. In this, the shareholder liability is limited in terms of shares and the amount paid or payable. The individual gets the share of the company or percentage of ownership when he/she put the money into the Pvt. Limited company.

Limited by Guarantee Company

Company formation of limited by gurantee company- Unlike the Pvt. Ltd company by share, the companies limited by guarantee have members, not shareholders. In this, the members of the company have a fixed amount as a liability that is called when the company is wounded. This fixed amount is guarantee fixed by the constitution of a company. If any loss occurs and the company does not have enough amount each member has to contribute a guaranteed amount. This kind of company is a non-profit organization and the guarantee amount cannot increase or decrease.

Advantages of Private Limited Company Registration

- One can start a company only with 2 members and a maximum of 200 members according to Company Act 2013.

- Each shareholder has limited liability for the company. This means if a company faces loss, the shareholder is supposed to sell their company share to pay the loss.

- The individual asset will be safe

- As per company law, if any shareholder or member dies or bankrupt, he continues to his existence in the company because he is not allowed to transfer his shares to others.

- A detailed statement of a company is called Prospectus and it goes to the public. However, Pvt. Ltd companies need not issue it because the public is not invited to donate for a share in a company

- A Pvt. Ltd company need 2 directors minimum and one of them should have stayed in India for 182 days minimum in the previous year of company registration.

- The Director of a company and shareholder can be the same person.

Public limited company

The public limited company formation requires generating registered securities to the public by offering a stock of the company for the first time on the stock exchange. A public company is not supposed to start the business just for the sake of gaining a firm registration certificate. A public limited company is eligible when it fulfils the following criterion

- Shareholders can transfer their share

- Can have 7 members including 3 director minimum and maximum has no limit

- The general public can invest in their share

- The minimum paid-up capital is 50 Lakhs

- A public limited company must obtain a trading certificate

Advantages of registering a company as a Public Limited Company

- The liability of a company is limited. This means an individual shareholder is liable for the payment in case of loss.

- Shareholder of a Public Limited Company and the company itself is a separate legal body according to Company Act 1956.

- The company should have a minimum of 3 members and a maximum of 15 members of the board of directors. Moreover, they can be elected from the company’s shareholders by shareholders.

- The elected directors are representatives of the other shareholders in taking decisions and managing the company.

- Public Limited company maintains transparency regarding the financial status to the owners themselves and to the future investors.

- Public Limited company has the freedom to raise the company’s capital from the public and by investing in the stock market.

- It has the authority to purchase and sold the company’s share in the market. Moreover, shares can be transferred to another member or people dealing on the stock market.

- Unlimited company

- More than 2 members are required to register a company

- A business organization in which liability of all members unlimited

- Member’s personal asset can be used to settle the loss or debt

- A public limited company can re-register itself on MCA under the company act in article 32

Sole proprietorship

In this company formation organization, the sole person handles the entire business and bears all the profits and losses. There is no separate law governing sole-proprietorship means the business owner is the same legal entity for business as sole-proprietor Company.

- No business registration is required as the business entity

- Just need to get GST registration if the annual turnover is 20lakhs above.

- The license of business under the Shop and Establishment Act

- A single person or director of the company funds the business takes profit and bears loos alone.

- A personal asset is of harm in case of loss because it is a loss of the business owner.

- Does not involve any accounting rule

- Will get the tax benefit if the annual turnover is less than 1cr

- The business owner bears all tax in case of any business profit because it is an unlimited liability firm

Partnership business

Company formation of the partnership business. This business is almost equal to Sole Proprietorship. The sole difference between sole proprietorship and partnership is more members are involved in partnership rather than one. As per the legal agreement, each partner’s role, share, and responsibility are defined.

- It is under the Indian Partnership Act 1932

- Partners share profit and loss of business

- In case of any loss, partners may have to use their own assets to compensate for the loss.

Limited liability partnership (LLP) Company

Company formation of limited liability partnership company. This kind of business registry was introduced in the year 2009. For LLP registration, the following criteria should be fulfilled

- More than 2 members are required to start a partnership company

- Under this, at least one member has unlimited liability and the rest has limited liability.

- The limited liability is extended to the contribution in the Limited liability company.

- This partnership does not dissolve on death or bankruptcy of any limited partner

- A separate legal entity governs the LLP than of partnership entity

- In a Limited Liability company, each partner’s business assets are separate from a personal asset

- In case, the business faces loss, the partner’s personal asset will be untouched as the maximum liability is already defined in capital share.

- Limited Liability company needs to maintain a financial record, tax record.

As compared to partnership and sole-proprietorship, investor’s choose a Limited Liability company because of their better credibility.

Company registration based on Control of the company

Company formation is based on the control of the company. When an individual or other company holds the shares of a private limited company, there exists as a holding or subsidiary company relationship. Here is the definition of holding company, and subsidiary company.

Holding companies

According to company law, when another company controls a parent company, it is a subsidiary company and the controlling company is called a holding company. Hence, ‘control’ is a term used in company law to distinguish the holding company. The control can be in two forms – control of the management or through the share ownership.

Subsidiary companies

A subsidiary company is a company whose control is in holding company hands. The holding company can control the board of directors or capital exercises or control more than half of the share capital of a company either its own or together with its other subsidiary company. It can be registered in Indian as a public limited company and private Limited Company, unlimited and sole-proprietorship.

The relationship between Holding and subsidiary company

- The composition of the board of directors of the subsidiary company can be controlled by a holding company.

- The holding company holds more than 50% of the total capital share of the subsidiary company

- The holding company A itself hold the capital share of subsidiary company B or B has its subsidiary company C then A has control over C automatically.

- The reason behind creating a Holding company

- The formation of this kind of company structure has a number of reasons such as

- When an international or Indian company set up a subsidiary company, it would have better control and unity of other subsidiary company.

- The ownership of the subsidiary is easy to transfer or share in a holding company-subsidiary company structure.

- Subsidiary and holding company structure have ease of fund.

- The tax benefit in setting up the subsidiary and holding company structure

How to decide which kind of limited company you should register on MCA

To know the answer, first, understand the advantages and disadvantages of the limited companies so that you will get clarity of company registration and company formation.

Private Limited company’s disadvantages

- Any shareholder cannot sell and transfer his/her shares to another person unless another shareholder agrees to the same.

- If you do not have funds or capital to invest in a company, still you cannot invite the public to invest in your company.

- In addition, it is compulsory to mention privately limited at the end of the company’s name.

Public limited company’s disadvantages

The disadvantages of public limited company are as follows:

- The issue of the prospectus is mandatory because the public limited company needs to be transparent so that the public can subscribe to its share.

- To subscribe to shares from the public, going public take time and it is expensive. Hence, the company has to hire an accountant and underwriter to prepare reports and disclosure of dealings with the company as per SEBI guidelines concerning IPO (initial public offerings).

- The public limited company faces equity dilution when an owner sells a part of his company’s ownership to the public or a stranger. Actually, an owner is selling a bit of his current equity position to another person.

- A public limited company may face difficulty to raise the money from shares that you need to operate the public company, so the owner itself hold the 51% shares of the company in his own control.

- Loss of management occurs when the public limited company becomes a private limited company because the owner of the company will have no right to make decisions separately. This is because the major shareholders have to be accountable to minor shareholders in company management.

- As per SEBI’s guidelines, the insider cannot affect the composition of the board of directors of the company. Mean, when private limited turns into public limited, the owner has no control in choosing the board of directors.

- Going public from private limited company increase the regulatory supervision by SEBI

- Unlike a private company, the public limited company has to present their quarterly and annual business report about the financial position, operations, compensation of officers, directors and other affairs. It has no privacy because it allows the public to purchase its share and invest in its stock.

- Increase in liability of directors and officers for the company’s mismanagement. As per law, the public company has to take responsibility for its shareholders in order to maximize the shareholder’s profit. For this, they need to disclose business operation information.

- The public limited company can face legal harassment in case of self-dealing, material misrepresentation to its shareholders or hiding information.

- Comparison between Private Limited company and Limited Liability Partnership

- This comparison will give you a clear glimpse of why people register as LLP, not as a limited company in India.

- Minimum 2 partners are needed for LLP company and maximum has no limit. On the other hand, 2 minimum shareholders are needed for the private limited company

- Both are registered with the registrar of companies and both the entities protect their partners or members from legal risk shooting from LLP and Limited Liability Company.

- The Tax is charged on the income of corporate in limited liability company. This means the company is imposed by the government of Indian to pay dividend distribution tax based on the dividend paid to the company’s investors.

- LLP’s taxation structure is simple. It is subjected to pay only income and alternate maximum tax. Dividend distribution is not applicable. Once the profit of an organization is declared, the tax is paid and the distributed income to the partners is tax-free.

Documents required setup a new company

For a new company formation, you will need the following documents.

- PAN card of the future director of the company for company registration

- Address proof of the future director with the same name mentioned as the address on the PAN card.

- For address proof, you can submit a Passport/Voter Id card/Ration card/Driving license/electricity bill/ aadhar card of India

- The documents must to up-to-date not older than 2 months.

- Two Passport Size Photograph

- Copy of Self Attested PAN of All Director/Shareholder Partners

- Copy of Self Attested Address proof of All Director/Shareholder Partners

- Electricity Bill of Premises for Office Registration

- NOC from the Landlord if the office is rented

- MOA – Objective of Company,

- AOA-Internal regulations of Company,

- INC-9 – Declaration from Promoters,

- DIR-2 – Consent for appointment as Director,

- NoC – NoC from the Owner of Premises for company formation

Points to be noted before incorporating a new company

- For company formation, select at least one suitable name and the other 6 names also indicative of the objective of the company.

- The name should not resemble any already registered company

- Apply to the concerned return on capital to determine the availability of name in eForm 1A by logging into the portal

- A fee of 500 Rs need to pay alongside and the digital signature of an applicant who is starting a company has to be attached in the form.

- If the suggested name is not available, the applicant needs to apply for the fresh name on the same application.

- When the name is available, the applicant can apply for registration of a new company by filing Form 1, 18, and 32 within 60 days of name approval.

- Arrange the documents of a memorandum of article and article of association by the solicitor inspection of the RoC.

- Attain a memorandum and article with appropriate stamp duty

- Get the article and memorandum signed by minimum 2 subscribers in his own hand/his father’s name/occupation/address and number of shares subscribed for and witnessed by a minimum of 1 person.

- Make sure the memorandum and article have a date after the stamping date.

- Login to the Ministry of External Affairs portal, fill out the form and attach the mandatory details mentioned in the eFrom. Visit the site for more information- Click Here

- The last step is to an eForm is attaching the scanned digital signature, pay the necessary filing and registration fee.

- Send the copy of the article and memorandum of association to the RoC

- After the process, the form is complete and corporate identity is generated. Obtain the certificate of incorporation from RoC

- For further info visit Click Here

The fee structure for registration on MCA

Please visit the site for the fee structure of registration of every kind of company and partnership- Click Here

The advantages of registering a company in India

A company registration has numerous benefits. A company that is licensed is authentic and increases the credibility of the company.

- It protects against personal obligations and protects against risks and loss.

- Helps build goodwill, and also helps the attraction of customers

- Provides investors with bank credit that is reliable and makes it easy to invest.

- It covers the responsibility to safeguard the assets of the company

- Greater commitment to wealth as well as greater stability

- Enhances the capacity to grow and develop large

For a comprehensive knowledge of the benefits of obtaining a registration for a business check out our article about the advantages of incorporating a company.

Leave a Reply