Have you bought a new car and need to Register it or need any other RTO services? If yes, you might be wondering about the different fees for different types of services or RTO charges in India. There are a lot of services provided by RTOs and each of them has some kind of categorization and subcategories. But don’t worry, in this post we will discuss all the RTO charges in India.

So, without wasting much time, here are all the RTO charges in India.

Types of RTO Charges Based on Different Services

On the basis of different services like Vehicle registration, Ownership transfer, there are various RTO charges or RTO taxes in India. RTO charges differ statewise according to state transport department and also respective RTO services have various RTO charges in India. The charges for the services can be paid using online payment facility as well.

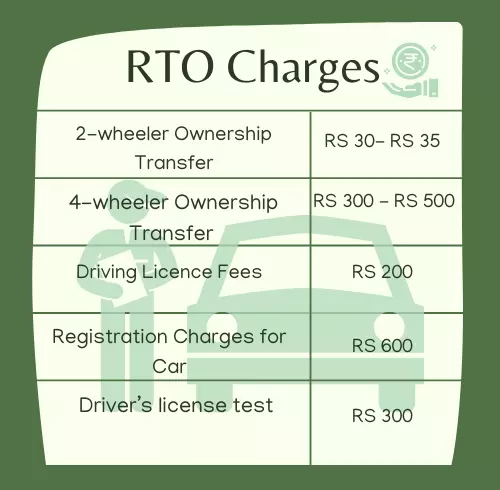

RTO charges for Ownership Transfer or RC Transfer

There are different RTO charges for different services availed and also as per the types of vehicles, RTO charges in India. The rto charges are given as below-

Two-wheeler Ownership Transfer Fees

These are two-wheeler Ownership transfer fees in India

- Generally, the ownership transfer fees in India is about Rs.30 to Rs.35 and it depends on the state and RTO.

- The smart card fee is Rs.200 (levied by the RTO)

- The total amount is about Rs.235.

Four-wheeler Ownership Transfer Fees

- The grand total for transfer of ownership of four-wheelers like car is between Rs. 300 and Rs. 500 (Excluding smart cards fees).

You can also find:

RTO Charges for Driving license fees

| Type of license-related issues | Old fees (In Rs.) | New fees (In Rs.) |

| Learner’s license | 30 | 200 |

| Learner’s license renewal | 40 | 200 |

| International driver’s license | 500 | 1,000 |

| Driving Licence Fees | 40 | 200 |

| Driver’s license test | 50 | 300 |

| Driver’s license renewal | 50 | 200 |

| Renewal license for driving schools | 2,000 | 10,000 |

| Issue of renewed driver’s license | 50 | 200 |

| Appeal fee against RTO | 100 | 500 |

| Issue of duplicate license for driving schools | 2,000 | 5,000 |

RTO Charges for Vehicle Fitness fees

| Sr. No. | Service | Fee |

| 1 | Conducting test of a vehicle for grant or renewal of a certificate of fitness | |

| Medium or Heavy motor vehicle | Manual: Rs. 600 | |

| Automated: Rs. 1000 | ||

| Three-wheeled or quadricycle or light motor vehicle | Manual: Rs. 400 | |

| Automated: Rs. 600 | ||

| Bike | Manual: Rs. 200 | |

| Automated: Rs. 400 | ||

| 2 | Grant or renewal of letter of authority | Rs. 15000 |

| 3 | Grant or renewal of a certificate of fitness for motor vehicle | Rs. 200 additional fees. |

| 4 | An appeal under rule 70 | Rs. 3000 |

| 5 | Issue of duplicate letter of authority | Rs. 7500 |

| 6 | Any application not covered under entries at Serial Nos. 1 to 14 above | Rs. 200 |

RTO Charges: Car registration charges and HSRP plate charge and other charges

| TYPE OF CHARGE | AMOUNT |

| Registration Charges | Rs. 600 – For all cars |

| Hypothecation Charges | Rs. 1,500 – If the purchased car is on a loan |

| Number Plate Charges | Rs. 230 – 400 – Same for HSRP Number Plate |

| Parking Fee/State Development Charges | Rs. 2,000 – MCD Parking Fees (cars under Rs. 4 Lakh)

Rs. 4,000 – MCD Parking Fees (cars above Rs. 4 Lakh |

| Temporary Registration Charges | Rs. 1,500 – 2,500 – Temporary Registration for up to 1 month |

| Road Tax Charges | Every State has their own Road Tax amount |

| FasTag Charges | Rs. 500 – 600 FasTag fees payable on purchase of the vehicle |

RTO Charges for Hypothecation Services

| Registration type | Old fees (In Rs.) | New fees (In Rs.) |

| Two-wheeler hypothecation | 100 | 500 |

| Motorbike registration | 60 | 50 |

| Three-wheeler hypothecation | 100 | 1,500 |

| Medium and heavy vehicles hypothecation | 100 | 3,000 |

| Transport license for cars and autos with white board | 200 | 600 |

| Transport license for cars and autos with yellow board | 300 | 1,000 |

| Passenger and cargo vehicles | 400 | 1,000 |

| Passenger and heavy cargo vehicles | 600 | 1,500 |

| Imported vehicle fee | 800 | 5,000 |

| Imported motorcycle fee | 200 | 2,000 |

RTO Charges: Fees and Registration Charges for Car & Bike Fancy Number Plate or VIP number price list :

| Serial Number | Category | Classified Numbers | Fees for Two-wheeler numbers |

| (i) | Golden | 0001, 0005, 0007, 0009, 0011, 0099, 0111, 0333, 0555, 0777, 0786, 0999, 1111, 0333, 4444, 5555, 7777, 8888, 9000, 9009, 9090, 9099, 9909, 9990, 9999 | Rs.5,000 |

| (ii) | Silver | 0002, 0003, 0004, 0008, 0010, 0018, 0027, 0036, 0045, 0054, 0063, 0072, 0081, 0090, 0100, 0123, 0200, 0222, 0234, 0300, 0303, 0400, 0444, 0456, 0500, 0567, 0600, 0678, 0700, 0789, 0800, 0888, 0900, 0909, 1000, 1001, 1008, 1188, 1818, 2000, 2345, 2500, 2727, 2772, 3000, 3456, 3636, 3663, 4000, 4455, 4545, 4554, 4567, 5000, 5005, 5400, 5445, 6000, 6336, 6363, 6789, 7000, 7007, 7227, 7272, 8000, 8008, 8055, 8118, 8181 | Rs.2,000 |

| (iii) | Others | Other numbers not mentioned in the above two categories | Rs.1,000 |

RTO Charges: Tax Charges for New Registration Car in Different Statesz

Below are Tax Charges for New Registration Car in Delhi

| Delhi | Price | Road Tax Fees for New Car Registration in Delhi |

| Delhi – Individual Registration | Upto Rs. 6 Lac | Petrol Cars – 4%, Diesel Cars – 5% |

| Between 6 Lac – 10 Lac | Petrol Cars – 7%, Diesel Cars – 8.75% | |

| More than Rs. 10 Lac as Ex-showroom Cost | Petrol Cars – 10%, Diesel Cars – 12.5% | |

| Delhi – Company Registration (Where Car Registered in name of Firm – Proprietorship / Partnership / Pvt Ltd / Ltd etc) | Upto Rs 6 Lac | Price – Petrol Cars – 5%, Diesel Cars – 6.25% |

| 6 Lac – 10 Lac | Petrol Cars – 8.75%, Diesel Cars – 10.94% | |

| More than Rs. 10 Lac as Ex-showroom Cost | Petrol Cars – 12.5%, Diesel Cars – 15.625% | |

Registration Charges in Uttar Pradesh

| Uttar Pradesh | Price | Road Tax Fees for New Car Registration in U.P. |

| U.P (Uttar Pradesh) | Less than 10 Lakh | 8% Road Tax. No separate classification of Petrol, Diesel |

| More than 10 Lakh | 10% Road Tax. No separate classification of Petrol, Diesel | |

| Ghaziabad, Noida, Kanpur, Meerut, Agra etc | Additional Temporary Charges of Rs. 1500 if buying Car from other District | |

| Used cars that are More than15 years old | Additional Green Tax Introduced in UP. | |

Registration Charges in Haryana

| Haryana | Price | Road Tax Fees for New Car Registration in Haryana |

| Haryana | Upto Rs. 6 Lac | 5% |

| Faridabad, Gurgaon etc | between Rs. 6 Lac – 20 Lac | 8% |

| above 20 Lac | 10% | |

| For CNG Car – 20% Rebate in Road Tax | ||

Registration Charges in Maharashtra

| Maharashtra | Price | Road Tax Fees for New Car Registration in Maharashtra |

| Mumbai, Pune, Nagpur, Navi Mumbai etc | Less than 10 Lakh | CNG vehicle 7%, Petrol vehicle 11%, Diesel vehicle 13% |

| between 10 Lakh – 20 Lakh | Petrol vehicle 12%, Diesel vehicle 14% | |

| Above 20 Lakh | Petrol vehicle 13%, Diesel vehicle 15% | |

Registration Charges in AP, Telangana

| Andhra Pradesh, Telangana | Price | Road Tax Fees for New Car Registration in A.P, Telangana |

| Andhra Pradesh, Telangana | Less than 10 Lakh | 12% |

| Hyderabad, Vijayawada ect | More than 10 Lakh | 14% |

| Additional : 2% RTO Tax, if you are buying 2nd Vehicle in same name | ||

Registration Charges in Kerala

| City / State | Price | Road Tax Fees for New Car Registration in Kerala |

| Kerala | Less than 5 Lakh | 9% |

| Calicut, Cochin, Trivandrum, Thrissur etc. | between 5 – 10 Lakh | 11% |

| More than 10 Lakh but Less than 15 Lakh | 13% | |

| More than 15 Lakh but less than 20 Lakh | 16% | |

| > 20 Lakh | 21% | |

| Electric Vehicle – Road Tax fixed at 5% irrespective of price | ||

Registration Charges in Karnataka

| Karnataka | Road Tax Fees for New Car Registration in Karnataka |

| Karnataka | Price < 5 Lakh – 13% |

| Bangalore, Mysore | Price between 5 – 10 Lakh – 14% |

| Price between 10 – 20 Lakh – 17% | |

| Price > 20 Lakh – 18% | |

| Additional: Road Tax Cess and Infra Cess which is calculated cumulatively at 11% of Calculated Road Tax amount | |

Registration Charges in Odisha

| Odisha | Price | Road Tax Fees for New Car Registration in Odisha |

| Odisha | Less than 5 Lakh | 6% |

| Bhubhaneshwar | between 5 – 10 Lakh | 8% |

| above 10 Lakh | 10% | |

Registration Charges in Tamil Nadu

| Tamil Nadu | Price | Road Tax Fees for New Car Registration in Tamil Nadu |

| Tamil Nadu | Less than 10 Lakh | 10% |

| Chennai, Combatore, Madurai | More than 10 Lakh | 15% |

Registration Charges in West Bengal

| West Bengal | Price and Type | Road Tax Fees for New Car Registration in West Bengal |

| West Bengal – Kolkata (One Time Tax for 5 Years) – whichever higher | Rs 17500 in 800 cc Cars | 5.5% |

| Rs 25000 in between 800cc to 1490cc Cars | 5.5% | |

| Rs 35000 in between 1490 to 1999cc Cars | 5.5% | |

| Rs 45000 in above > 2000cc Cars | 5.5% | |

| West Bengal – Kolkata (LifeTime Tax for 15 Years) – whichever higher | Rs 40000 in 800 cc Cars | 10% |

| Rs 55000 in between 800cc to 1490cc Cars | 10% | |

| Rs 80000 in between 1490 to 1999cc Cars | 10% | |

| Rs 1 Lakh in above > 2000cc Cars | 10% | |

Registration Charges in Chandigarh

| Chandigarh | Price | Road Tax Fees for New Car Registration in Chandigarh |

| Chandigarh | All Cars Priced under 20 Lakh | 6% |

| Above 20 Lakh | 8% | |

Registration Charges in Punjab

| Punjab | Price | Road Tax Fees for New Car Registration in Punjab |

| Punjab | All Cars Priced under 15 Lakh | – 9% Road Tax |

| Ludhiana, Amritsar, Jalandhar, Patiala, Bhatinda | Above 15 Lakh Price Cars | – 11% Road Tax |

Registration Charges in Gujarat

| Gujarat | Price | Road Tax Fees for New Car Registration in Gujarat |

| Gujarat | 6% (Individuals Cases). | |

| 12% (For Company) and applied on Factory Price For CKD Imported Cars – Road Tax will be Double the rates of CBU Cars. | ||

| Ahmedabad, Surat, Vadodara etc | Additional tax: You have to pay Municipality Tax in some Selected Municipal District of Gujarat | |

| additional tax 5% on buying SUV and Luxury Cars in Company Name | ||

Registration Charges in Rajasthan

| Rajasthan | Engine CC | Road Tax Fees for Car Registration in Rajasthan |

| Rajasthan | Under 800 cc | Petrol, CNG Cars: 6%s |

| More than 800 cc and under 1200 cc | Petrol, CNG Cars: 9% | |

| More than 1200 cc | Petrol, CNG Cars: 10% | |

| Jaipur, Alwar, Bikaner, Ajmer etc | > 800 cc and under 1200 cc | Diesel Cars: 11%, Else 12% |

| Additional Charge: 12.5% of Road Tax Payable | ||

| Additional Green Tax:

· Rs 2500 (Engine < 1.5 Lit), · Rs 3500 (Engine > 1.5 Lit but under 2 Litre, · Rs 5000 for Cars Engine > 2 Litre). · Additional Green Tax of Rs 2500 over an above for cars(5 seater or more) with engine > 2 Litre |

||

Registration Charges in Bihar

| Bihar | Price | Road Tax Fees for New Car Registration in Bihar |

| Bihar | under 8 Lakh | 9% |

| Patna, Gaya etc | between 8 Lakh to 15 Lakh | 10% |

| above 15 Lakh | 12% | |

Registration Charges in Jharkhand

| Jharkhand | Price | Road Tax Fees for New Car Registration in Jharkhand |

| Jharkhand | under 15 Lakh | 6% |

| Jamshedpur, Ranchi, Dhanbad | above 15 Lakh | 9% |

| Additional Tax: Further additional 3% Tax (For buying 2nd Car in name of Same Owner) | ||

Registration Charges in Uttarakhand

| Uttarakhand | Price | Road Tax Fees for New Car Registration in Uttarakhand |

| Uttarakhand | Up-to 5 Lakh | 8% |

| Dehradun, Rishikesh | between 5 Lakh to 10 Lakh | 9% |

| above 10 Lakh | 10% | |

| Additional Green Tax: Rs 1500 (Petrol) / Rs 3000 (Diesel Cars).

No Green Tax applied on CNG |

||

Registration Charges in Himachal Pradesh

| Himachal Pradesh | Price | Road Tax Fees for New Car Registration in H.P. |

| Himachal Pradesh | —- | For now, it is about 2.5% to 3% but it will be revised and increased up-to 8% to 10% of Price of Car-Price |

| Shimla, Solan |

Registration Charges in Puducherry

| Puducherry | Price | Road Tax Fees for New Car Registration in Puducherry |

| Pondicherry (Puducherry) | Cars under Rs 5 Lakh | Minimum Rs 8000 Tax |

| Cars in 5 Lakh – 8 Lakh | Rs 11K | |

| Cars in 8 Lakh – 15 Lakh | Rs 15K | |

| Cars above Rs 15 Lakh – 20 Lakh | Rs 60K Flat Road Tax | |

| Cars in Rs 20 Lakh – 30 Lakh | Rs 1.1 Lakh Flat Road Tax | |

| Cars above Rs 30 Lakh | Rs 1.25 Lakh |

Registration Charges in Madhya Pradesh

| Madhya Pradesh | Price | Road Tax Fees for New Car Registration in MP |

| Madhya Pradesh – MP Indore, Gwalior & other cities in MP | ex-showroom under 10 Lakh | 4% (Electric cars), 8% (Petrol, CNG cars), 10% Diesel cars |

| ex-showroom above 10 Lakh but under 20 Lakh | 4% (Electric cars), 10% (Petrol cars), 12% (Diesel cars) | |

| car price above 20 Lakh | 4% (Electric cars), 14% (Petrol cars), 16% (Diesel cars) | |

Registration Charges in Chhattisgarh

| Chhattisgarh | Price | Road Tax Fees for New Car Registration in MP |

| Chhattisgarh – Raipur, Bilaspur, Bhilai, Korba and other cities in Chhattisgarh | Cars under 5 Lakh | 8% |

| Cars above 5 Lakh | 9% | |

Registration Charges in J&K

| J&K | Road Tax Fees for New Car Registration in J&K |

| Jammu & Kashmir | 9% Road Tax for all cars |

Registration Charges in Assam

| Assam | Price | Road Tax Fees for New Car Registration in Assam |

| Assam | cars priced up-to 4 Lakh | 5% Road Tax |

| cars priced from Rs 4.01 Lakh to 6 Lakh | 6% Road Tax | |

| Cars price from Rs 6.01 Lakh to 12 Lakh | 7% Road Tax | |

| Cars from 12.01 Lakh to 15 Lakh | 7.5% Road Tax | |

| Cars from 15.01 Lakh to 20 Lakh | 9% Road Tax | |

| Cars above 20 Lakh | 12% Road Tax |

Also Read Fees and Charges

Registration Charges in Goa

| Goa | Price | Road Tax Fees for New Car Registration in Goa |

| Goa | Cars less than 6 Lakh | 9% |

| at Ex-showroom Price from 6 Lakh till 9.99 Lakh | 11% | |

| Car costing 10 Lakh and more | 12% |

FAQs

1) Can we pay RTO fees or charges online?

Yes ,you can pay RTO fees or charges online through online payment option on government parivahan website .

2) Do RTO tax charges differ statewise?

According to the rules and regulation , there are different rto taxes or fees/charges in various states of India.

M C BEHERA

Very good and educative.