In this article, we will discuss how to apply for pan card online and what documents are required for pan card online application to complete the process. In addition, we will also discuss the types of pan cards. Knowing importance and need of Pan card today ,keep reading to find out the answers.

PAN: Permanent Account Number

Permanent Account Number is a 10-digit alphanumeric unique number. PAN issued by the Income-Tax Department (ITD)as per the Income Tax Act & Rules. In addition, Financial institutions and agencies also need a Permanent Account Number.

Apply for Pan Card NSDL

How to apply for pan card nsdl: The applicant may either make an online application through official website or submit a physical PAN Application to any of the following

- TIN-FC (Tax Information Network Facility Centre) or

- PAN centre of NSDL ( National Securities Depository Ltd.)

Applicants should go through the instructions and guidelines provided in the application form before filling the form. Before moving further with the topic of how to apply for pan card online and what documents are required for pan card online application.

Types of Pan Cards:

1. Application for allotment of PAN: –

Fresh application for either an applicant who has never applied for a PAN or does not have PAN allotted to him. The applicant may visit the website Income Tax India to check the allotment for PAN.

The following forms are required for submitting applications for allotment of new PAN:

FORM 49A: – Filled by Indian citizens including Non-resident Indians.

FORM 49AA: – Filled by foreign citizens.

2. Application for new PAN Card or/and Changes or Corrections in PAN Data: – Similarly, those who have already obtained the PAN and wish to get the new PAN or, want to make some changes/corrections in their PAN data by submitting their applications in the above form prescribed by ITD.

Request for new pan card or/and changes or correction in pan data’:

Indians as well as foreign citizens, should use the same form. Also, ITD issues the applicant a new PAN bearing the same Pan but updated information. Now you know the types of pan cards available. Let’s begin with how to apply for pan card online| apply for pan card nsdl

How to apply for PAN card online

How to apply for pan card online: Firstly, only Indian citizens should use this form for submitting an application for the allotment of PAN. Indian citizens located outside India should also use this form.

Secondly, the applicant will initially register by selecting Form 49A. Enter the required details and submit your pan card online application.

Thirdly, a token number will generate and displayed to the applicant before filling out the form.

In addition, the token number is sent on e-mail ID (provided in the application form) for reference purposes.

Fourthly, a facility to save the details entered in the pan card online application form will appear before the final submission by using this temporary token number. As a result, the applicant can view and edit the data.

Fifthly, the applicant can select any one of the four options mentioned below while filling online PAN application. That’s how to apply for pan card online.

How to apply for pan card online : The options to select for pan card online application

1. Submission of physical form and documents after online data entry:

Above all, the applicant has to print the generated application form, with recent color photographs, duly sign in the space provided.Also, forward along with prescribed supporting documents to NSDL e-Gov address.

Thus, Aadhaar details are considered as PAN application details and Aadhaar as supporting documents and would be forwarded to the Income Tax Department for allotment of PAN.

The photograph and all details used in the Aadhaar card would be used in PAN card Hence, PAN card will be dispatched at the address mentioned in Aadhaar.

That is to say, no need to send a PAN application form and supporting document to NSDL e-Gov.

2. Scanned based – Aadhaar based e-Sign:

The applicant needs to upload scanned images, signature and supporting documents.

Certainly, Aadhaar would be considered as a supporting document.

Thus, no need to send a PAN application form and supporting document to NSDL e-Gov.

However, original documents Certificate of identity in Original signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councilor or a Gazette officer, Bank certificate in Original on letterhead from the branch, Employer certificate in original) will be required to be forwarded in physical form to the NSDL e-Gov address.

3. Scanned based – Digital Signature Certificate (DSC):

An applicant needs to upload scanned images of photos, signatures and supporting documents while making an application.

Likewise, no need to send a PAN application form and supporting document to NSDL e-Gov.

However, original documents Certificate of identity in Original signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councilor or a Gazetted officer, Bank certificate in Original on letterhead from the branch, Employer certificate in original) will be required to be forwarded in physical form to the NSDL e-Gov address. I’ll now wrap up the discussion on how to apply for pan card online. Further, I will discuss what documents are required for pan card online application. How to submit the documents and what are the fees for pan card application online as well as offline So, go ahead and read the rest of the article.

Points to note:

As you know how to apply for pan card online. In some cases, if the data submitted fails in any format level validation, a response indicating the error(s) will be displayed on the screen. Thus, the applicant shall rectify the error(s) and re-submit the form.

If there are no format level error(s), a confirmation screen displays the data filled by the applicant.

The applicant may either edit or confirm the same.

While submitting the PAN application form, the applicant will have to indicate whether a physical PAN card is required. After you apply for pan card nsdl. Please read the payment guidelines listed here before making payment.

Important note to consider before payment

Above all, PAN applicants should indicate an application for a paperless or physical pan card at the time of submission of the PAN application.

If the applicant chose for physical PAN Card. Consequently, a physical PAN card will be printed & dispatched to the communication address.

Accordingly, the e-PAN card in PDF format will be dispatched at the e-mail ID mentioned in the PAN application form if the same is provided.

In such cases, email ID will be mandatory and an e-PAN Card will be sent to the PAN applicant at the email ID.

Therefore, the applicants will not receive a physical PAN Card in such cases. Let’s see the fee for applicants to apply for pan card nsdl

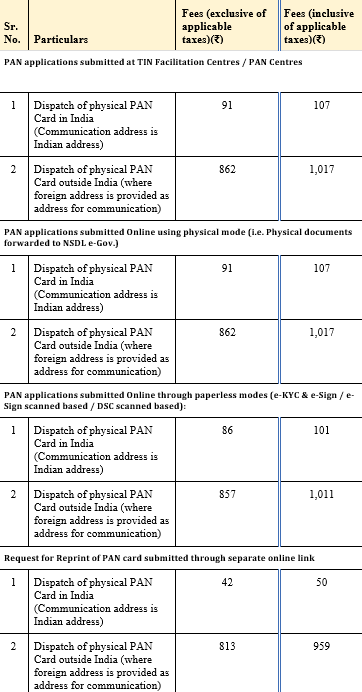

User fees

Here are the user fees for the pan card online application. While filling the online form if any of the addresses i.e., office address or residential address is a foreign address, the payment can be made through credit card/debit card/Net banking / Demand Draft payable at Mumbai (drawn in favor of ‘NSDL – PAN). At present this facility is available for a select list of countries.

In addition, applicants from other countries may contact NSDL e-Gov contact information at the government website

If the online application is made through e-KYC & e-Sign paperless application/ e-Sign scanned based/ DSC scanned based option (i.e., other than physical mode). Then the payment can be made only through Credit Card/Debit Card or Net banking.

Likewise, the name of the applicant and the acknowledgement number should be mentioned on the reverse of the demand draft.

During, a successful credit card/debit card / net banking payment, an acknowledgement will be displayed. Provided that, the applicant saves and print the acknowledgement and send it to NSDL.

Furthermore, to regenerate acknowledgement receipt and fill the details accordingly

Acknowledgement

On confirmation, of payment by credit card/debit card / net banking, an acknowledgement screen with a downloadable acknowledgement receipt will be displayed. After that, an e-mail containing this acknowledgement receipt (in PDF) as well as payment receipt (in PDF) as attachments will be sent to the applicant’s e-mail ID mentioned in the application.

Above all, the applicant shall save and print this acknowledgement.

‘Applicants making for allotment of new PAN should affix two recent colour photographs (3.5 cm x 2.5 cm) in the space provided in the acknowledgement. Besides, the photograph should not staple or clip to the acknowledgement.

Signature / Left-hand thumb impression should be provided across the photo affixed on the left side of the acknowledgement in such a manner that portion of signature/impression is on the photo as well as on acknowledgement receipt.

The signature/ left thumb impression SHOULD NOT BE ON THE PHOTOGRAPH affixed on the right side of the acknowledgement. However, there is any mark on this photograph such that it hinders the clear visibility of the face of the applicant, the application may not be processed.

Signature / left thumb impression should only be within the box provided in the acknowledgement.

Provided that, a Magistrate or a Notary Public or Gazetted Officer, under official seal and stamp, must attest a thumb impression I’ll conclude user fees for the applicant to apply for pan card nsdl. I have discussed how to apply for pan card online. Let’s see what are the ways of submitting documents for your pan card application online. Further, I will discuss what documents are required for pan card online application.

Ways of submitting documents

If a Physical mode of submission is selected in Online PAN application then the acknowledgement duly signed, affixed with photographs along with demand draft, with required documents needs to be sent to NSDL e-Gov at ‘Income Tax PAN Services.For e-KYC & e-Sign, e-Sign based or DSC based online PAN application, there is no need to send physical documents to NSDL e-Gov as all these are paperless mode of PAN application.

It is mandatory to quote Aadhaar /Enrolment ID of the Aadhaar application form, for making an application for allotment of Permanent Account Number (Form 49A) and copy of Aadhaar allotment letter / Copy of Enrolment ID receipt of Aadhaar application form should also be enclosed along with the acknowledgement.

Superscribe the envelope with ‘APPLICATION FOR PAN — N-15 digit Acknowledgement Number’ (e.g. ‘APPLICATION FOR PAN — N-881010200000097’).

The acknowledgement, demand draft (if any), and documents must reach NSDL within 15 days from the date of online application.

Applications received with demand draft as a mode of payment will process only on receipt of relevant proofs and realisation of payment.

Applications received with credit card/debit card / net banking as mode of payment shall be processed on receipt of relevant documents (acknowledgement and proofs). I’ve already talked about how to apply for pan card online. Further, I will discuss what documents are required for pan card. So, keep reading

Fees

Physical PAN Card

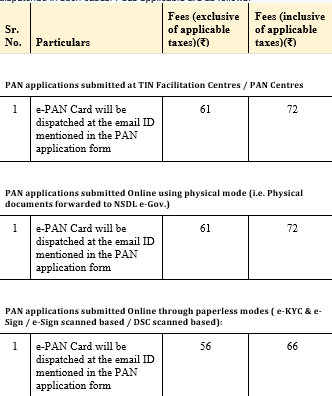

For paperless Pan

Fees applicable are as follows:-

fees for paperless pan application

What Documents Required for pan card

Proof of Identity

(i) Copy of any of the following documents bearing the name of the applicant as mentioned in the application:-

Aadhaar Card issued by the Unique Identification Authority of India; or

Elector’s photo identity card; or

Driving License; or

Passport

Ration card having a photograph of the applicant; or

Arm’s license; or

Photo identity card issued by the Central Government or State Government or Public Sector Undertaking; or

Pensioner card having a photograph of the applicant; or

Central Government Health Scheme Card or Ex-Servicemen Contributory Health Scheme photo card

(ii) Certificate of identity in Original signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councilor or a Gazetted officer

(iii) Bank certificate in Original on letterhead from the branch (along with name and stamp of the issuing officer) containing a duly attested photograph and bank account number of the applicant

Note:

In case of Minor, any of the above-mentioned documents as proof of identity and address of any of parents/guardians of such minor shall be deemed to be the proof of identity and address for the minor applicant.

Proof of Address

(i) Copy of any of the following documents bearing the address mentioned in the application:-

Aadhaar Card issued by the Unique Identification Authority of India; or

Elector’s photo identity card; or

Driving License; or

Passport

Passport of the spouse; or

Post office passbook having an address of the applicant; or

Latest property tax assessment order; or

Domicile certificate issued by the Government; or

Allotment letter of accommodation issued by the Central Government or State Government of not more than three years old; or

Property Registration Document; or

(ii) Copy of following documents of not more than three months old

(a) Electricity Bill; or

(b) Landline Telephone or Broadband connection bill; or

(c) Water Bill; or

(d) Consumer gas connection card or book or piped gas bill; or

(e) Bank account statement or as per Note 2 ; or

(f) Depository account statement; or

(g) Credit card statement; or

(iii) Certificate of address signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councilor or a Gazetted officer

(iv) Employer certificate in original

Note

Proof of Address is required for residence address mentioned in item no. 7.

In case of NRI, a copy of Bank Account Statement in the country of residence or copy of Non-resident External (NRE) bank account statements (not more than three months old) shall be the proof of address

Proof of date of birth

Copy of any of the following documents bearing the name, date, month and year of birth of the applicant as mentioned in the application:-

Aadhaar card issued by the Unique Identification Authority of India;or

Elector’s photo identity card; or

Driving License; or

Passport

Matriculation certificate or Mark sheet of the recognized board; or

Birth certificate issued by the municipal authority or any office authorised to issue birth and death certificate by the Registrar of Birth and Deaths or the Indian Consulate.

Photo identity card issued by the Central Government or State Government or Central Public Sector Undertaking or State Public Sector Undertaking; or

Domicile certificate issued by the Government; or

Central Government Health Service Scheme photo card or Ex-servicemen Contributory Health Scheme photo card; or

Pension payment order; or

Marriage certificate issued by the Registrar of Marriages; or

An affidavit stating the date of birth That’s all about the documents required for pan card. Now, you know what documents are required for pan card.

Conclusion

I will conclude the topic how to apply for fan card | what documents required for pan card online application. To sum up, the application for the allotment of PAN can be made through online or offline mode.

Further, requests for changes or corrections in PAN data or requests for a reprint of PAN card (for an existing PAN) can also be done.

The pan card online application can be made either through the portal of TIN-NSDL or the portal of UTITSL

Finally, on successful application and payment, the applicant should send the supporting documents through courier/post to NSDL/UTITSL.

NSDL/UTITSL process Pan card application.

Subsequently, when the authorities process the PAN, they will send the pan card by post for physical pan card and by email for e – PAN

Towfeeq Ahmad khawaja

No link

Towfeeq Ahmad khawaja

Plzz sar mobile number link

Anil Kumar

Mera pan card khov gay phone number bhiy khov gay