If you lost pan card and looking for how to get pan card if lost, Itzeazy has got you covered. Unfortunately if you do not have any photocopy of your pan card .Wondering ? What to do if I lost my pan card and I don’t know the number? Do not worry, in this article you will get to know all details about how to get pan card number if lost?

I lost my pan card and I don’t know the number

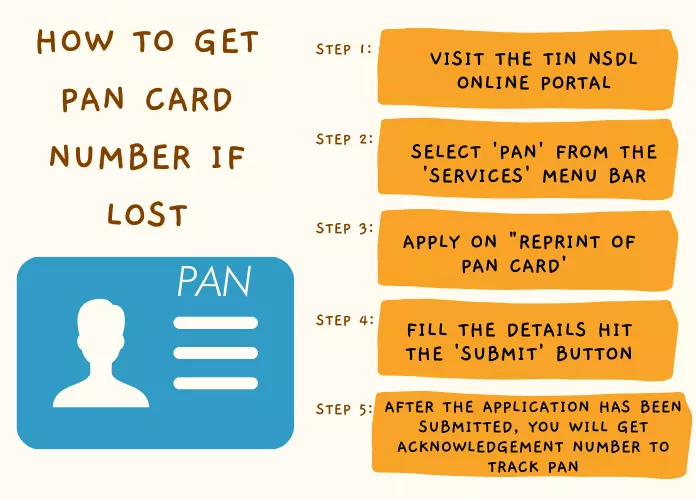

In case of “I lost my pan card and I don’t know the number” No, need to worry you just have to reissue your pan card. Follow these simple steps for how to get pan card number if lost (reissue pan card).

- Visit the TIN NSDL online portal

- Select ‘PAN’ from the ‘Services’ menu bar

- Under ‘Reprint of PAN Card,’ click ‘Apply.’

- Enter the details hit the ‘Submit’ button and follow the on-screen instructions.

- When the application is successfully submitted, an acknowledgement number is provided, which allows the application to be tracked.

How to get pan card number if lost?

How to get Pan Card if lost Online?

If you find yourself in the situation of “I lost my pan card and I don’t know the number” All you have to do is apply for pan card reissue. Here steps are given how to get pan card if lost:

- Visit TIN-NSDL onlineservices.nsdl and select the application type as “Changes or correction in existing PAN data/ Reprint of PAN card (No changes in existing PAN data)”.

- Fill in the information marked as mandatory and then submit it.

- You will receive a generated token number in your email-id provided by you on the previous page.

- Select any one of the modes of submission of your PAN application form.

- You have to select whether you need a physical PAN card or an e-PAN card. If you select an e-PAN card, then you have to provide a valid email id. The email-id provided will receive the digitally signed e-PAN card.

- Fill details in the “Contact & other details” and also the “document details” page and submit the application.

- The site will direct you to the payment page and on completing the payment and generate a 15 digits acknowledgement number.

- You can check the status of your duplicate PAN card using the 15 digits acknowledgement number generated. StatusTrack.

- When the ITD receives the application

NOTE: Modes of Submission of PAN are:

1.Forward application documents physically :

Print the acknowledgement form generated after payment with the copies of documents required and sent by the registered post to the PAN services unit of NSDL .

2. Submit digitally through e-KYC & e-sign (Paperless) :

- This option requires the use of Aadhaar.

- All of the information from your Aadhaar card should be used solely in the duplicate PAN card application.

- An OTP will be sent to the Aadhaar registered number to verify the information provided.

- You are not required to upload any photos, signatures, or other documents.

- You will require to give your digital signature (DSC)to e-sign the form while submitting the final form through this option.

3. Submit scanned images through e-sign :

For this option, Aadhaar is mandatory but you will have to upload scan images of photograph, signature and other documents.

Only an OTP will authenticate the application form.

The authorities will dispatch a duplicate PAN card within 2 weeks

This is where I’ll bring the discussion to a close. “I lost my pan card and I don’t know the number what to do as well as how to get pan card number if lost?”

Procedure to apply for Duplicate PAN Card

PAN (Permanent Account Number) is required to open a bank account, file a tax return, invest in financial instruments, or engage in any other financial activity. The PAN Card contains the cardholder’s PAN and personal information.

The Permanent Account Number search identifies an individual for taxation reasons and stores all of the individual’s pertinent financial data. As a result, knowing your Permanent Account Number is essential for many parts of your financial life.

PAN applicants can apply online for a duplicate pan card or Reprint of PAN card (only when there is no change required in data) by clicking the following link Online NSDLPAN holders whose latest PAN application was processed through NSDL e-Gov and/ or e-filing portal of Income Tax Department can use this facility. Option for an update of PAN details will not be available through this facility.

Fees for Lost Pan Card

Request for Reprint of PAN card submitted through the separate online link

Check out the previous section if you are in a situation – lost my pan card and I don’t know the number

- Dispatch of a physical PAN Card in India (Communication address is an Indian address) – 52 rupees

- Physical PAN Card dispatch outside India (when communication address is a foreign address) – 959 rupees

The application of a duplicate pan card should be used when PAN has already been allotted to the applicant but the applicant requires a PAN card. Therefore the Income Tax Department will issue a new PAN card bearing the same PAN details to the applicant.

When do you need a duplicate PAN Card?

A duplicate pan card is needed in any one of the following situations:

- Misplaced or theft

- Damaged PAN card

- change in name or address

You are facing the situation of I lost my pan card and I don’t know the number. You want to apply for lost pan card offline, here is a step-by-step guide to help you.

How to link pan card with aadhaar card

How to get duplicate PAN card offline?

- Download and print the “Request for new PAN Card or/ and Changes or Correction in PAN Data” form.

- Fill the application form in block letters.

- Attach 2 passport size photograph with signature. Do not sign on the passport size photograph

- Send the application along with the payment, proof of identity, proof of address and proof of PAN to the NSDL facilitation centre.

- After receiving payment print the generated acknowledgement form containing 15 digit number

- The facilitation centre then sends your application to the Income-tax PAN services unit for further action.

- You can check the status of your duplicate PAN card using the 15 digit acknowledgement number generated. By clicking on StatusTrack

- When the department receives the application, they will dispatch the duplicate PAN card within 2 weeks

What should you do in these circumstances? If I lost my pan card and I don’t know the number, how to get pan card number if lost, lost pan card? Just apply for pan card reissue. However, there are a few points you should keep in mind.

PAN Card application status online

Points to note: Pan card reissue online

There is no requirement of submitting an application form along with supporting documents for processing this PAN card reprint request.

Read the guidelines below to know more.

- For Changes or Corrections in PAN data, fill all mandatory fields (marked with *) of the Form

and select the corresponding box on the left margin of the appropriate field for required correction.

- If the application for issuance of duplicate PAN card without any changes in PAN related data of the applicant,

fill all fields in the Form but do not select any box on the left margin.

- In case of either a request for Change or Correction in PAN data or a request for re-issuance of a PAN Card without any changes in PAN data,

the ITD database will update the address for communication using the address for communication provided in the application.

Can I block my PAN card number?

No, you can not block PAN card number if lost your Pan card. Just you can make FIR for preventing any misuse otherwise It need to apply for PAN reissue.

Can I obtain a new PAN card with new number?

NO, you can not obtain new PAN card with new number. It is not allowed by the income tax law to keep more than one PAN number.

harpreet singh

losts

yuvraj b dandge

my pan lost a give pan number

Bharat devram rajdev

My pan Card missing and pan nambar lost

Mohimur Rahman Choudhury

Please my father name change

Vengatesan

Respected sir

Vengatesan

Respected sir and Medam my pan card missing new pan card apply your please

Srikanth

My card is lost..pls give me pan card nom pls

Eyilobeni

Please it’s urgent i need pan card number

Wanisha Phawa

Plss send me I lost my pancard

Gowramma

I lost my pan card and I don’t know pan number how to know my pan number

Philman uthansingh

Please help me sir 🙏🙏

Montazul mollick

Montazul mollick

I lost my pan card and I don’t know pan number how to know my pan number

HL Laxshmi

Dear Sir,madem this is nagaraj my wife pancard lost number also not know pls send the pancard number