Are you looking to download your PAN card instantly and hassle-free? You’re in the right place!

In this article, we will guide you through the entire process of obtaining an instant PAN card, which is now easier than ever. Whether you’re an Indian national, NRI, or even a foreign entity, you can benefit from this quick and efficient method.

Imagine having a digital version of your PAN card, readily available on your computer or smartphone. No more worrying about misplacing the physical card!

Stay with us as we explain how you can apply for an e-PAN through NSDL, UTIITSL, or using your Aadhaar card. We’ll also discuss eligibility criteria and the steps involved in the process. Let’s dive into the world of instant PAN card acquisition!

e-PAN Card

You can get a digital version of your physical PAN card called an e-PAN card. A virtual PAN card that may be used for e-verification is known as an e-PAN card. Your e-PAN will save all of your PAN information on your computer or smartphone.

To get a new PAN, Indian nationals and NRIs (including corporations, NGOs, partnership firms, municipal authorities, trusts, and so on) must fill out Form 49A. For foreigners and foreign companies, Form 49AA is necessary.

Send these forms and other required PAN documents to the Income Tax PAN Services Unit. In this segment, we will talk about how to download instant pan card.

You can apply for an e-PAN via the NSDL or UTIITSL portal. You can also download an instant PAN using your Aadhaar card. The e-PAN card shows the following cardholder information:

- Permanent Account Number

- Name

- Father’s Name

- Gender

- Date of Birth

- Photograph

- Signature

- QR code

Pan card status check by mobile number

Change name in pan card as per aadhaar

Pan card details by name and date of birth

Ways to download instant PAN card:

Here are a few ways to how to download instant pan card:

How to download instant pan card via NSDL

Applicants who applied through the NSDL website have the option of downloading their e-PAN through the NSDL portal.

You can download any new PAN application or change application for free within 30 days of getting confirmation from the IRS. If you don’t, you’ll have to pay additional fees.

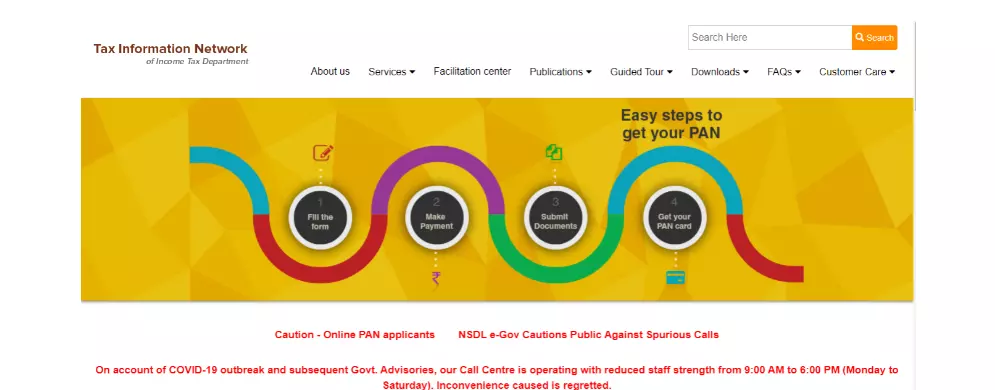

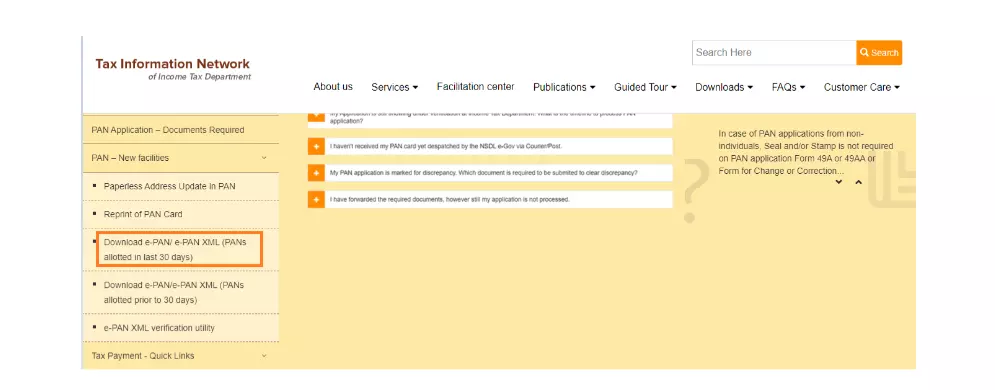

- Step 1: Go to the TIN-official NSDL’s website.

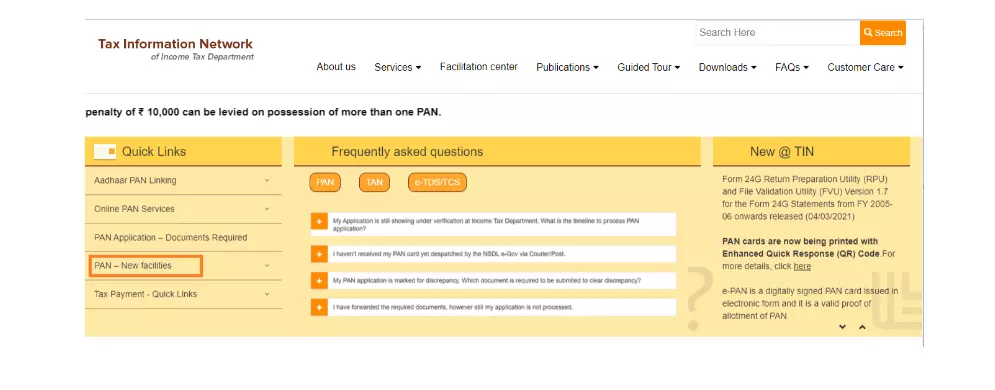

- Step 2: Select ‘PAN-New facilities’ from the ‘Quick Links’ menu.

- Step 3: Choose ‘Download e-PAN/e-PAN XML (PANs allotted in the previous 30 days)’ or ‘Download e-PAN/e-PAN XML (PANs allotted before 30 days)’ from the dropdown menu, as appropriate. You will be sent to a different page.

- Step 4: Enter your PAN number, Aadhaar number, date of birth/incorporation, and GSTN on the PAN page (if applicable).

- Alternatively, you may input the Acknowledgement number and date of birth/incorporation in the ‘Acknowledgement Number’ tab.

- Step 5: Read the terms and conditions and check the boxes.

- Step 6: Complete the captcha and submit the form.

- Step 7: Select one of the options and then click Generate OTP.

- Step 8: Finally, input the OTP and click “Validate” to complete the process.

- Step 9: Select “Download PDF” from the drop-down menu. The e-PAN card is now available in pdf format for download. It is protected by a password, which is your birth date.

This is one of the ways how to download instant pan card.

Downloading an instant Pan Card Using UTIITSL

Applicants that applied through the UTIITSL site have the option of downloading their e-PAN. If you don’t, you’ll have to pay additional fees.

Follow the below ways on how to download instant pan card:

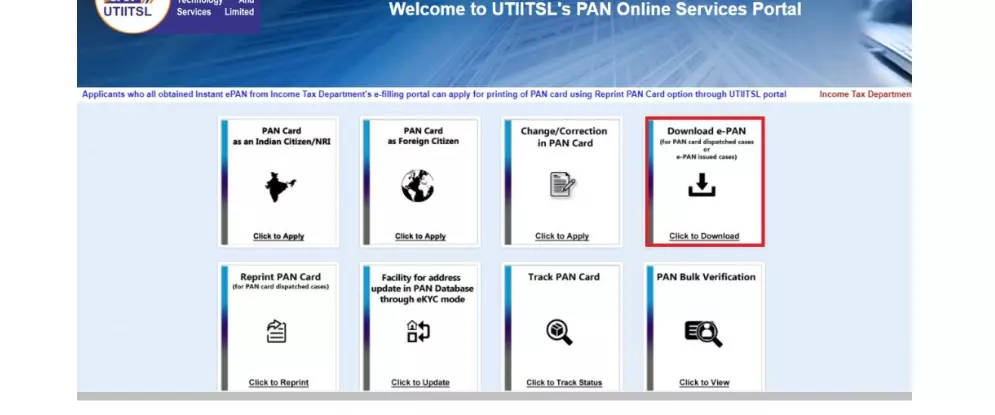

- Step 1: Go to the UTIITSL portal’s official site, where you may get the PAN.

- Step 2: Select ‘PAN Card Services’ from the drop-down menu.

- Step 3: Select ‘Download e-PAN’ from the drop-down menu.

You will be sent to a different page.

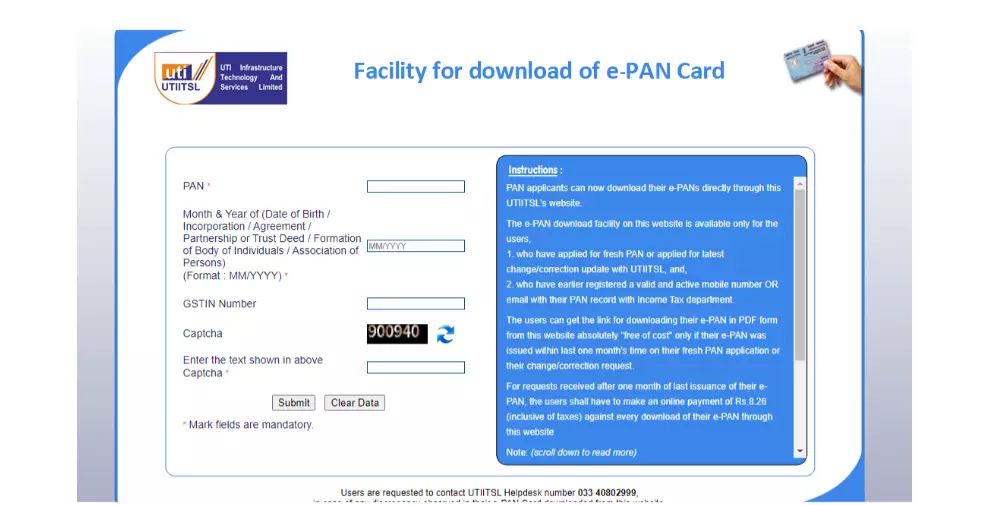

- Step 4: Type in your ten-digit alphanumeric PAN number. Fill in your date of birth as it appears on your documentation. If necessary, include your GSTIN number.

- Step 5: Complete the captcha and submit the form. Your registered cellphone number or email address will get a link.

- Step 6: After clicking the link, you may use the OTP to get the e-PAN Card.

This is yet another method on how to download instant pan card.

How to get pan card number if lost?

How to link pan card with aadhaar card

How to download Instant Pan Card through Aadhar:

To know or use how to download instant pan card via aadhar card, citizens must be at least 18 years old and have an Aadhaar number. You can use this service if you have never been assigned a PAN before.

if you are looking for how to download instant pan card this is another method.

Visit the income tax e-filing portal and follow the guidelines below to apply for a PAN quickly:

- Step 1: Under the “Quick Links” menu, select the “Instant PAN using Aadhaar” option.

- Step 2: Select ‘Get New PAN’ from the drop-down menu.

- Step 3: Put your Aadhaar number in the box.

- Step 4: Confirm your application by entering the captcha code in the picture box.

- Step 5: To obtain an OTP on your registered cellphone number, click on ‘Generate Aadhaar OTP.’

- Step 6: After you enter the OTP, you will get an acknowledgement number right away through email and SMS.

How to Download Instant Pan Card Using the Income Tax e-Filing

If you want an alternate method on how to download instant pan card, read below:

- Step 1: Go to the IRS’s official e-filing website.

- Step 2: Under the “Quick Links” menu, select the ‘Instant PAN with Aadhaar’ option.

- Step 3: Select ‘Check Status/Download PAN’ from the drop-down menu.

- Step 4: Submit your Aadhaar number and captcha code as shown in the picture box.

- Step 5: Using your registered mobile phone number and email address, generate an OTP and submit it.

-

Once you successfully verify the OTP, you will be taken to a new online page where you can track the status of your PAN application. If your e-PAN card is ready, you can download it from this tab.

Eligibility for e-PAN Applications:

The following criteria are required to be met to how to download instant pan card:

- You must be a citizen of India.

- You must be a self-employed individual.

- An Aadhaar card is required.

- Your Aadhaar card information must be current.

- Your Aadhaar card should be connected to your phone number.

- Let’s have a look at the steps for downloading an e-PAN from NSDL, UTIITSL, and the income tax e-filing portal.

Using the above methods you can understand and get to know how to download instant pan card.

FAQs

Q1: Why do we need a PAN card?

A1: A PAN card is a unique number that is used to track your financial transactions and tax payments.

Q2: Is PAN card necessary for everyone?

A2: No, PAN card is not necessary for everyone, but it is required for taxpayers, individuals who earn more than ₹5 lakh per year, and individuals who wish to engage in certain financial transactions.

Q3: Who is eligible for PAN card?

A3: All Indian citizens and residents are eligible for PAN card.

Q4: Is it OK to not have PAN card?

A4: It is not OK to not have a PAN card if you are required to have one. Not having a PAN card can result in penalties and make it difficult to engage in financial transactions.

Q5: Is PAN necessary for students?

A5: Students are not required to have a PAN card unless they earn more than ₹5 lakh per year or engage in certain financial transactions.

Q6: Where my PAN card is used?

A6: Your PAN card is used for a variety of purposes, including filing income tax returns, opening a bank account, investing in mutual funds, buying a house, selling a property, applying for a loan, and applying for a passport.

Venkatesh

Date of birth change