Every car, bike or other registered vehicle must pay road tax under Motor Vehicle Act, 1988. Road tax in Delhi is collected by State Government and helps maintain and improve road infrastructure. In this article, we will discuss how to pay Delhi road tax online. We will also discuss Delhi road tax for two wheelers, four‑wheelers and commercial vehicles.

Road tax Delhi

Road tax (also called vehicle tax) is money you pay to State Government when you register your vehicle. Every state in India has its own rates, so amount in Delhi is different from other states. In Delhi, tax depends on weight of your car.

Every vehicle owner in Delhi have to pay road tax as per rules set by Delhi Government. Tax amount depends on vehicle type and category.

Delhi has different road tax rates for:

- Cars and other four wheelers

- Two wheelers

- Commercial vehicles

Road Tax for Two Wheelers in Delhi

Here is road tax Delhi for two-wheelers:

| Vehicle Type (Unladen Weight) | Annual Tax Amount in Rs |

| motorcycle<50cc | 650 |

| Scooters and motorcycle>50cc | 1220 |

| Tricycle | 1525 |

| Motorcycle accompanying sewing trailer | 1525+465 |

Delhi Road tax for car

Here is road tax slabs set by RTO Delhi for cars and other four-wheelers. Road tax in Delhi depends on vehicle weight.

| Vehicle Type (Unladen Weight) | Annual Tax Amount in Rs. |

| Motor car<1000kg | 3815 |

| 1000kg>motor car<1500kg | 4880 |

| 1500kg>motor car<2000kg | 7020 |

| Motor car>2000kg | 7020+4570+2000 for additional 100kg |

Delhi road tax for commercial vehicle

Road tax rules for commercial vehicles in Delhi are different from private vehicles. Tax is based on passenger capacity for passenger vehicles and loading capacity for goods vehicles.

Road Tax for Passenger Commercial Vehicles

Delhi road tax for passenger commercial vehicles depends on number of passengers, except driver and conductor.

| Vehicle Type | Annual tax payable in Rs. |

| Maximum 2 passengers, excluding the driver | 305 |

| Between 2 to 4 passengers, excluding driver and conductor | 605 |

| Between 4 to 6 passengers, excluding driver and conductor | 1130 |

| Between 6 to 18 passengers, excluding driver and conductor | 1915 |

| More than 18 passengers, excluding driver and conductor | 1915 for 18 passengers + 280 for every extra passenger |

Road tax for goods carrying vehicles

Road tax for goods vehicles depends on loading capacity:

| Loading capacity of the goods carrying vehicle | Annual road tax payable in Rs. |

| Under 1 tonne | 665 |

| More than 1 tonne but less than 2 tonnes | 940 |

| More than 2 tonnes but less than 4 tonnes | 1430 |

| More than 4 tonnes but less than 6 tonnes | 1915 |

| More than 6 tonnes but less than 8 tonnes | 2375 |

| More than 8 tonnes but less than 9 tonnes | 2865 |

| More than 9 tonnes but less than 10 tonnes | 3320 |

| More than 10-tonne | 3790 |

Road tax for trailers in Delhi

| Additional 10 tonnes plus less than 2-tonne | Rs.3790+Rs.465+Rs.470 for every tonne |

| Additional 10 tonnes plus more than 2-tonne | Rs.3790+Rs.925+Rs.470 for every tonne |

How Road Tax is Calculated in Delhi?

Delhi road tax for a vehicle depends on several factors decided by government authorities. These include:

- Vehicle type

- Fuel form of registered car

- Purpose of usage

- Invoice rate of the car

- Age of the car

- Weight of the car

- Engine capacity

- Passenger capacity

Based on these factors, road tax is calculated as per rules under Delhi Motor Vehicles Taxation Act, 1962. For private vehicles, road tax is paid one time at registration. For commercial and goods vehicles, tax can be paid yearly.

You can also visit official Parivahan website and enter vehicle details to check exact road tax amount.

Measures Against Non-Payment of RTO Tax in Delhi

If Delhi road tax is not paid on time, penalty charges apply on unpaid amount.

If vehicle is sold or transferred without clearing Delhi road tax, new owner may become liable to pay pending tax and penalty, as per Delhi Motor Vehicles Taxation Act, 1962.

Vehicles used only for agricultural purposes on land owned by registered owner are exempt from Delhi road tax. These purposes include:

- Tilling, harvesting, sowing, etc.

- Transport of seeds, manure, insecticides, etc.

- Carrying any agricultural produce to garage locations after which to market.

If vehicle from another state enters Delhi and road tax has already been paid in home state, no additional Delhi road tax is required for up to 90 days.

Delhi road tax online payment

You can pay Delhi road tax online through Parivahan portal by following steps below:

- Visit official Parivahan website

- Sign in using mobile number and email ID

- After login, go to Online Services

- Enter vehicle registration number and generate OTP

- After verification, select Tax Fees under relevant service

- Enter required details like vehicle registration, insurance and registration date

- Pay tax using net banking, debit card or credit card

- Download or print payment receipt for record

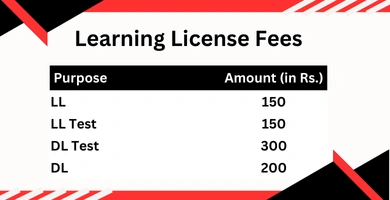

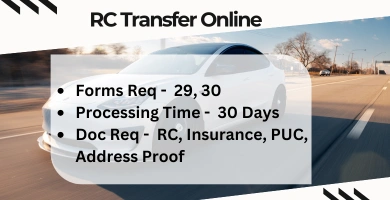

RC transfer fees for vehicle in India

Medical Fitness Certificate for Driving License: Apply for One in 2022

1 Pingback