PAN card correction now online

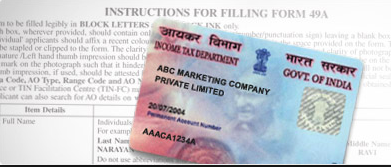

You can correct mistakes in the personal information of Permanent Account Number and Aadhaar document with the online facility recently made available by the Income Tax Department.

This facility comes with the provision to link biometric identifier Aadhaar with PAN. Two separate hyperlinks on its e-filing website are provided. One to update changes in existing PAN data or for application of new PAN by an Indian or a foreign citizen and the other one is for updating Aadhaar details by logging into ‘Aadhaar Self Service Update Portal’ using the unique identity number. The individual can then upload scanned documents as proof for data update requests.

Presently out of 25 crores PAN cardholders only as low as 1.22 crore assessees have linked Aadhaar with PAN. While 111 crore people have Aadhar documents. Presently the number of people filing income tax returns is only 6 crore which is abysmally low.

The Finance Bill 2017-18 was amended to mandate income tax returns filing and linking of PAN with the Aadhaar number. This amendment was introduced by Finance Minister Arun Jaitley with an objective to curb the malpractice of tax evasion by people through the use of more than one PAN card.

As a step towards implementation of the bill, last week, the income tax department introduced the facility to enable a taxpayer to link his Aadhaar and PAN.

With this facility introduced by the Income-tax Department, the assessee can now provide PAN and Aadhaar number along with his/her name as per the Unique Identification Authority of India (UIDAI) data, after verification from the UIDAI, the linking will be confirmed. In case of any incongruence in the Aadhaar name provided, Aadhaar OTP will be sent to the mobile number registered with the UIDAI.

For more information pls. visit www.itzeazy.com or www.itzeazy.in

Leave a Reply