Do you want to know what is PAN No ? In this article,you will get all the information about pan such as pan card history, when pan card started in India, pan card structure and pan gir no (General Index Registration)Number.

What is PAN NO?

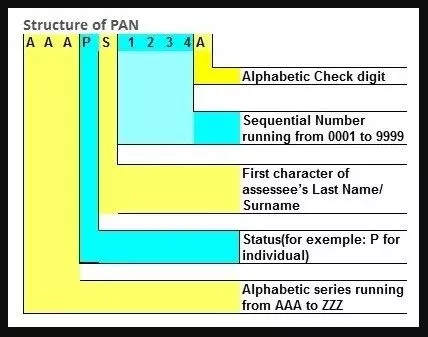

Wondering what is pan no? Permanent Account Number (PAN) is a code that acts as an identification for Indian nationals, especially those who pay Income Tax. Pan no is a unique, 10-character alpha-numeric identifier, issued to all judicial entities identifiable under the Indian Income Tax Act, 1961.

An example number would be in the form of ARLPA0061H. It is issued by the Indian Income Tax Department under the supervision of the Central Board for Direct (CBDT) and it also serves as an important proof of identification.

PAN is basically a method of identifying a taxpayer on the computer system through a unique All-India number so that all information relating to that taxpayer, e.g. taxes paid, refunds issued, outstanding arrears, income disclosed, transactions entered etc. can be linked to him through the computer system.

This was all about what is pan no or information about pan. I’ll now go over the pan card history and when pan card started in India. Let’s see what was the old system of identifying taxpayer, the pan gir no.

Pan Card History

Earlier the assesses of the Income-tax Department were identified by their General Index Register (GIR) Number. This pan gir no was essentially a manual system. The GIR number was unique only within an Assessing Officers Ward / Circle.

Because the pan gir no was not unique across the country, PAN was created to address these issues.

When Pan Card started in India?

Permanent Account Number (old series) was first introduced in 1972 and made statutory under section 139 A of the Income Tax Act w.e.f. 1st April 1976.

Blocks of Permanent Account Numbers were allotted to each Commissioner Charge by the Board. The Commissioners made the allotment of Permanent Account Numbers to assess under various Assessing Officers in their charge from within the Block allotted to them. Initially, the allotment was made manually.

Why pan card structure failed

The PAN under the old series failed to meet the desired objectives for the following reasons:

- No database was maintained and there was no check to avoid allotment of multiple PANs to a taxpayer;

- The data captured under the computerised system was not structured and was limited to very few parameters – Name, Address, Status and designation of A.O.

- PAN was not permanent as the jurisdiction of the assessee was part of the PAN and, therefore, was prone to changes with the change in jurisdiction.

- The allotment of PAN was not centralised – an assessee could apply for allotment of PAN in different centres and get a distinct PAN from each centre, due to which all India uniqueness could not be achieved.

Pan Card Format Under New Series

Since a taxpayer can make payment of taxes or have monetary transactions anywhere in India. A unique all India taxpayer-identification number is essential for linking and processing transactions/documents relating to a taxpayer on computers, as also for data matching.

Therefore, a new series of Permanent Account Number was devised which took care of the above limitations. When compared to today, the definition of what is pan no is different. Section 139A of the Act was amended w.e.f. 1.7.95 to enable allotment of PAN under new series to persons residing in areas notified by the Board.

Applications for PAN allotment under the new series became mandatory in Delhi, Mumbai, and Chennai on 1.6.96, and in the rest of the country on 11.2.98. This is the evolution of the pan card over time. This was all about the history of pan cards or the pan card history| information about pan

What are the objectives of introducing new series of PAN?

You know what is pan no? In Pan card history, PAN card structure was introduced keeping in view the following objectives:

- Facilitate linking of various documents and information, including payment of taxes, assessment, tax demand, arrears etc. relating to an assessee.

- Make it easier to find information.

- Facilitate the matching of information relating to investment, raising of loans and other business activities of taxpayers collected through various sources, both internal as well as external, for widening of tax base and detecting and combating tax evasion through non-intrusive means.

How to apply for a business PAN card

PAN Card application status online

Format of the new series of PAN

When pan card started in India, they were not well received because some flaws existed, such as the fact that pan gir no was not unique to everyone. As a result, new pan series was introduced.

The Permanent Account Number under the new series is based on the following constant permanent parameters of a taxpayer and uses the Phonetic Soundex code algorithm to ensure uniqueness.

- Full name of the taxpayer;

- Date of birth / Date of Incorporation;

- Status;

- Gender in case of individuals; and

- Father’s name in case of individuals (including in the cases of married ladies)

These five fields are called core fields, without which PAN cannot be allotted.

The PAN under the new series is allotted centrally by a customized application system (IPAN / AIS) for all-India uniqueness. The system automatically generates a 10 character PAN using the information in above five core fields.

PAN Card Format:

The phonetic PAN (PPAN) is a new concept that helps prevent the allotment of more than one PAN to assessee with the same/similar names. AIS works out the PPAN based on some important key fields of an assessee using an internal algorithm. At the time of PAN allotment, the PPAN of the assessee is compared with the PPANs of all the assessees to whom PAN has been allotted all over the nation.

If a matching PPAN is detected, a warning is given to the user and a duplicate PPAN report is generated. In such cases, a new PAN can only be allotted if the Assessing Officer chooses to override the duplicate PPAN detection.

A unique PAN can be allotted under this system to 17 crore taxpayers under each alphabet and under each status. (i.e. individual, HUF, Firm, Company, Trusts, Body of Individuals, Association of Persons etc.)

FAQs

Can we check PAN No online?

Yes,you can chek Pan No online through website https://www.incometax.gov.in/iec/foportal/

Can minor get Pan card in India?

Minor can get Pan card in India.It requires consent leter from parents.

What is the validity period of a PAN NO?

PAN No is issued for life time. Thus there is no as such expiry date for Pan card.

For more information on PAN cards, log on to www.itzeazy.com

Abuobaida

👋

Dipak Chalak

Pan card mobile number change.

Guguloth Ravindar

Sir i loss my pan card place help me

Ajay Shankar Tumsare

Pan card Heshtore dakava sir ji