Are you wondering what PAN card 10 digit meaning is ? Its really interesting to know PAN card meaning . Every letter or digit in the PAN card number has special significance. In this blog we will explain it in detail.

The Income Tax Department issues PAN card with the assistance of authorized district-level PAN agents, UTI ITSL (UTI Infrastructure Technology And Services Limited), and formerly National Securities Depository Limited NSDL. NSDL operates many TIN-Facilitation Centers and PAN centers across the country to assist citizens in obtaining their PAN Card. .

The PAN issuing process is based on the PPP (Public-Private Partnership) paradigm. This is done to keep the cost, efficiency, and efficacy of handling, processing, and issuing PAN applications as low as possible and to have a number that is PAN card number .

What is the PAN Card Meaning?

The full form of PAN card is permanent account number . PAN identification system is a computer-based system that issues a unique identification number to each Indian tax-paying individual or organization. All tax-related information of a person is recorded with this single PAN number, which works as the primary key for information storage. Because this is shared throughout the country, no two people on tax-paying entities can have the same PAN.

How to change address in pan card India online 2022

How to get pan card number if lost?

What is PAN Card 10 digit meaning?

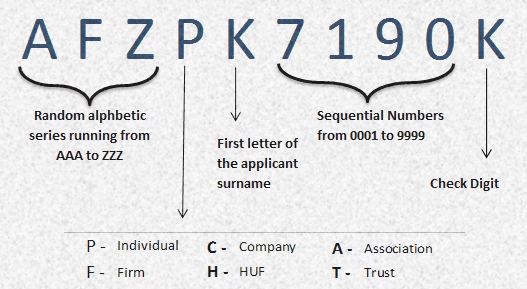

PAN card 10 digit has special significance . The Income Tax Department issues a ten-digit unique alphanumeric number known as a PAN. PAN card 10 digit formation is detailed below:

- The first three characters, out of the first five from the PAN card 10 digit number, indicate the alphabetic series going from AAA to ZZZ.

- The fourth character is P or it can be the name of the entity, trust, society, or organization, in the case of company/HUF/Firm/AOP/trust/BOI/local authority/artificial judicial person/government, where the fourth character is “C”, “H”, “F”, “A”, “T”, “B”, “L”, “J”, “G”. ALWPG5809L, for example. The fourth character of P of the PAN holder’s status (E.g., ALWPG5809L). The fourth letter category is defined below:

A — AOP (Association of persons)

B — BOI (Body of individuals)

C — Company

F — Firm

G — Government

H — HUF (Hindu Undivided Family)

L — Local authority

J — Artificial juridical person

P — Person (Individual)

T — Trust (AOP)

- The fifth character of the PAN card is the first character of either: the person’s first name, surname, or last name, in the case of a “personal” PAN card, were

- The final (tenth) letter is an alphanumeric digit used as a check-sum to validate the existing code.

This all is the detail of Pan card 10 digit meaning.

What is Pan Card number meaning?

When a PAN card number is assigned to an individual or organization, the Income Tax Department also issues a PAN Card. PAN is a number, but PAN Card is a tangible card that includes your PAN as well as your name, date of birth (DOB), father’s or spouse’s name, and a photograph.

Copies of the Pan card can be used as proof of identification or date of birth. Also, the PAN card 10 digit contains mix of alphabets and numbers.

What are the types of PAN Applications?

The following are the types of Pan applications that can be filed for:

Application for PAN allotment:

This application should be utilized if the applicant has never applied for a PAN or if he does not have a PAN number that has been allotted to him.

FORM 49A, Application for New PAN Card or/and Changes or Corrections in PAN Data:

Those who have already obtained a PAN and wish to obtain a new PAN number or make some changes/corrections to their PAN data must submit their applications in the form provided by ITD:

‘APPLICATION FOR NEW PAN CARD OR/AND CHANGES OR CORRECTION IN PAN DATA’:

Both Indian and international citizens can use the same form (49A/49AA).

What are the uses of PAN Card?

The below mentioned are some of the uses of the Pan card :

General Uses:

- Because the PAN Card contains information like name, age, and photograph, it can be used as legal identity evidence throughout the country.

- The PAN is the best way to keep track of your tax payments. Otherwise, it is not valid, you may be obliged to pay it several times.

- Because each PAN number is unique, it is very difficult to use it for tax evasion or other nefarious purposes.

- PAN Cards can be used to obtain utility services such as power, phone, LPG, and internet.

For Financial Transaction:

- When we pay direct taxes, the PAN is required.

- When filing income tax, taxpayers must enter their PAN.

- PAN information must be given when you register a business.

- PAN information you must require for some financial operations. These are some of the transactions:

- Purchase or the sale of property (immovable) of worth Rs.5 lakh or more.

- Purchase or the sale of a vehicle except for a two-wheeler.

- Payments which are made to hotels and restaurants that exceed Rs.25,000.

- Payments made in connection with international travel needs. If the amount exceeds Rs.25,000, you must quote your PAN Payments of more than Rs.50,000 towards bank deposits

- Purchase of the bonds worth at least Rs.50,000

- Purchase of the share’s worth at least Rs.50,000

All details mentioned above is stating the Pan Card meaning and uses.

I hope all the information about the Pan number meaning, Pan card 10 digit meaning, Pan Card meaning and Pan card number meaning is clear. But still, you have any queries to ask you can mention that in the comment box.

Avnish kumar

New pan cad

Avnish kumar

Mhuje pan cad banbanahe