Each Business/Company requires a business PAN card, also known as a Company PAN card. The procedure to apply for a business PAN card is simple and time-saving. Let’s see the procedure for applying a Business PAN card online in detail. The post depicts you with types of PAN card, online procedure, and documents required for applying company PAN card.

Apply for the Company PAN card

First, you will need to understand the concept of a PAN card and a business PAN card. PAN is an acronym for Permanent Account Number. It is a 10-digit long number with the first 5 characters being letters, the next four characters being numbers, and the last character also being a letter.

PAN card is issued by the Income Tax Department under the Income Tax Act, 1961. This number is the identity of every tax-paying individual or entity. The main purpose of a PAN card is to prevent tax evasion.

Bifurcation of 10 digits :

- The first three characters of the number are a sequence of letters like JJJ, or PPP, or OOO in Capital. It can be anything between AAA and ZZZ.

- The fourth character of the number is also an alphabet that identifies the type of holder who’s getting the card. Like ‘P for person/individual’, ‘G for government’, ‘C for a company’, ‘F for a firm’, and many others.

- The fifth character of the number is also a letter that represents the First Letter of the Surname of a person in the case of an Individual or the First Letter of the Name of the Entity in the case of a business.

- The next four characters of the number are digits that are given by the authority.

- And the last character of the number is also a letter, which is given by the authority, so that the authority can check the validity of that number when being in use.

PAN card is compulsory for all-whether you are an individual, a company, a partnership firm, an organization, or any other body.

Before taking a look at the procedure for a business PAN card online, let’s see the definition of a Company PAN Card.

Business PAN Card

Anybody who has a business or is setting up a business, needs to have a PAN card, and that PAN card will be called a Business PAN card or Company PAN Card.

The bodies which come under business are as follows :

- Micro company

- Small company

- Large company

- Startup company

- One-person company

- Partnership

- Limited liability partnership (LLP)

- Proprietorship

- Trust

- Non-government organization (NGO)

- Corporate

- Society

- Association

- Private limited company

- Foreign institutional investors

- Incorporations

- Cooperative society

Why is a Business PAN Card a requirement

Following are the requirements for a business PAN card :

- The government has made it compulsory, even if you are not eligible to pay tax.

- PAN is essential at the time of filing an Income Tax Return (ITR).

- If a business does not hold a PAN card, the government has the right to charge a tax of more than 30% from that business.

- A business will only be eligible to obtain a Tax Registration Number (TRN) if that business has a PAN card.

How to apply for a business PAN card

The application procedure for a company PAN card is quite simple. You can apply in both online and offline modes as per your preference.

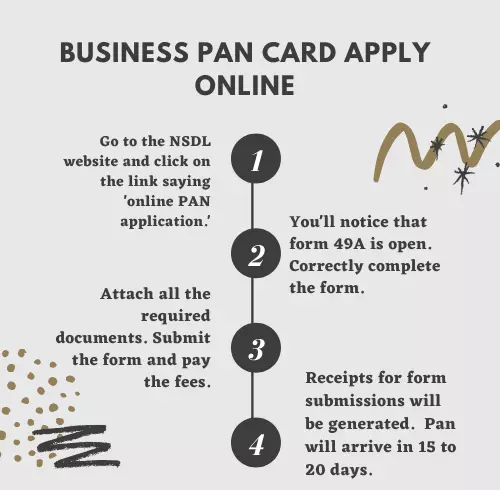

Business PAN card apply online

Here is the online process for the company PAN card

- Go to the NSDL website and click on the link saying ‘online PAN application.’

- You will see that Form 49A is open. Fill the form properly.

- Attach all the required documents.

- Submit the form and pay the fees.

- Form submission acknowledgements will be generated.

- The pan will be delivered to your registered office address between 15 and 20 days.

Business PAN card application offline

- Go to the NSDL site.

- Print form 49A.

- Fill out the form properly and attach all the required documents.

- Submit the form with all the attached documents to the nearest NSDL office with a fee of Rupees 110.

- The office will issue an acknowledgment that the documents have been submitted.

- The PAN card will be delivered to your registered office address within 15 to 20 days.

You can find the nearest NSDL office address on the TIN website of the government.

How to get pan card number if lost?

Documents required for a business PAN card

Following are the documents required for a business PAN card :

- Proof of address of the business’s registered office.

- A copy of the certificate of incorporation of the business.

- Bank draft for the payment of fees if applying offline.

- Copy of the partnership deed if you are a partnership firm or a Limited Liability Partnership firm.

- Proof of date of birth in case of a sole proprietorship firm.

- Certificate of registration issued by the registrar of firms if you are a Limited Liability Partnership.

- Copy of the trust deed if you are a trust.

- Copy of the certificate of registration number issued by the Charity Commissioner if you are a charity.

- Proof of Identity in case of a sole proprietorship firm.

- Proof of address in case of a sole proprietorship firm.

- A copy of the certificate of registration issued in the country where the applicant is located is attached by the Indian embassy in case of a foreign company.

- Any other document originated from the state or central government in establishing that business.

Some important points to keep in mind while applying for a company PAN card –

- The form should be filled in Block letters only.

- Only if applying offline, the form should be filled using a black pen

- The form should be filed using only the English language.

- Avoid any corrections or overwriting on the application form in case of applying through offline mode.

- The method of paying the fee can differ based on whether your business is in India or abroad.

- The form should be only signed by an authorized signatory in the case of a firm, or by the CEO in any other case.

- All the documents should be attached properly that are required by the authority.

Conclusion

The validity and existence of a business depends on its Business Pan Card or Company Pan Card, also.

Having a business PAN card (Company PAN card) is a necessity for every business entity, as it is not only useful for tax purposes, but it also gives businesses a lot of benefits as well. That’s all about the business PAN card application online

Leave a Reply