Have you applied for a PAN card and are eagerly waiting for it to arrive? Do you want to know how to track the status of your PAN card application?

This blog post will provide you with all the information you need to know about tracking the status of your PAN card application. You will learn how to check the status of your application using your name, date of birth, or acknowledgment number.

By the end of this blog post, you will be able to track the status of your PAN card application with ease.

Ready to discover how to check the status of your PAN Card, whether through UTI, SMS, phone call, or online tracking? Let’s get started on the path to knowing your PAN Card status with confidence and convenience. Read on to find out how to keep tabs on your PAN Card application – it’s as simple as a few clicks and a little patience. Happy tracking!

What is PAN?

Permanent Account Number (PAN) is a code that acts as an identification for Indian nationals, especially those who pay Income Tax. It is a unique, 10-character alpha-numeric identifier.

It is issued by the Indian Income Tax Department under the supervision of the Central Board for Direct Taxes (CBDT) and it also serves as an important proof of identification. In the further section, we will discuss the procedure for track pan application. To know how you can do pan cardtrack keep reading.

Purpose of PAN

- Its primary purpose is to provide a universal identification number for all financial transactions.

- Additionally, the tracking of monetary transactions of high-net-worth individuals that may affect the economy may prevent tax evasion.

- Having a PAN card simplifies and streamlines the taxation system for the government

- Providing the government with sufficient information and providing transparency in financial transactions.

- PAN is unique to each individual and is valid for the lifetime of the holder, throughout India.

- An important point to note would be that once issued, the PAN is not affected by a change of address. Hence, the emphasis is on PAN applications.

Now without further ado let’s see how can you check uti pan card status by name and pan cardtrack by date of birth and how can you track your pan card application status online. How to check status of PAN Card or track pan application? Know your pan status hassle-free

How to Check UTI PAN Card status by name and date of birth

If you don’t have the acknowledgement number, you can use your name and date of birth to check pan card application status online. So, here’s how to check uti pan card status by name and pan cardtrack date of birth:

- Click on the following link: tin.tin.nsdl.com, then select PAN- New/Change Request, then fill in your first, middle, and last names, as well as your date of birth, before clicking the submit button.

That’s all about uti pan card status by name and pan cardtrack by date of birth. Know your pan status. Now let’s have a look at how to check status of pan card. Follow the simple steps to track pan application.

How to check status of PAN Card

PAN Card application status usually takes around 15 working days for an individual to receive his/her PAN after applying for it. The government, on its part, makes it easy for an applicant to track the application status by providing a 15 digit acknowledgement number to each applicant. An applicant can choose between three modes to track PAN application status online, as mentioned below.(pan cardtrack )

-

Via SMS –

Applicants can do pan cardtrack track through their phone, using a specialised SMS service. An individual can do this by sending an SMS to NSDLPAN followed by their 15 digit acknowledgement number to 57575. They will receive an SMS indicating their current application status.

-

Via Telephone call –

Know your pan status via call. An applicant can call the TIN call centre to receive an update on the current application status. One can reach this call centre on 020-27218080 and will be required to provide his/her application acknowledgement number.

-

Via Online tracking –

Track your pan card online. Applicants can choose to track their application online, through the official website of TIN-NSDL. Applicants can track their PAN card application status online.

-

Via Speed post

Visit India Post’s official website. Choose Consignment Tracking Portal. Enter the consignment number, then the security code. Continue by clicking the “search” button. The status of your PAN card delivery is displayed on the screen.

To know other ways for how to check status of pan card keep reading. Know your pan status

Note: An applicant can track pan card application status online 3 days after the submission. Doing pan cardtrack within 3 days might not provide accurate updates.

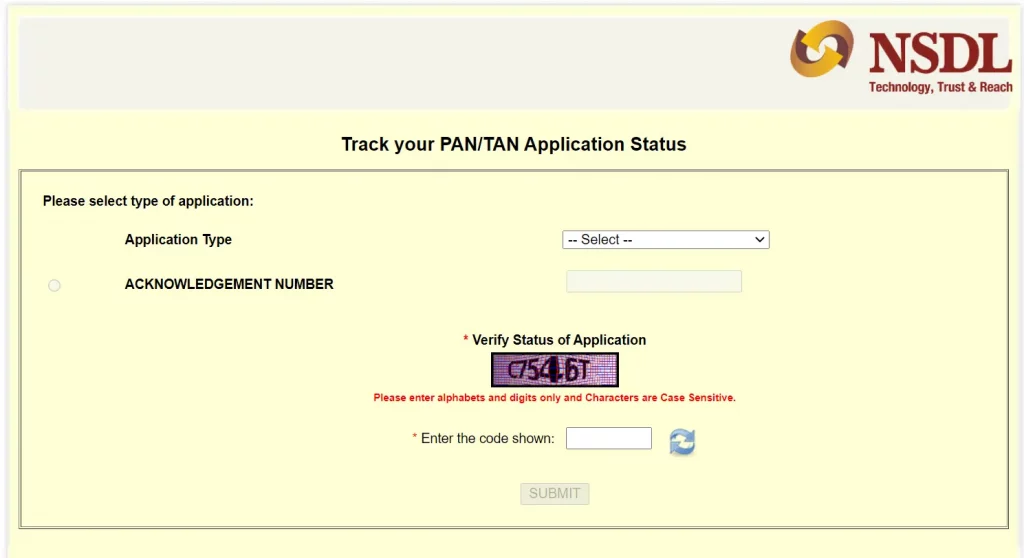

Check NSDL PAN Card application status online

Tracking of a pan card application status online is perhaps the most popular and fastest mode of tracking, with applicants expected to follow a few simple steps to stay abreast of any changes in their application status. Here is how to check status of pan card or pan cardtrack

- To know your pan status log on to the official website for PAN, TIN-NSDL and navigate to the PAN section of the website. Once on this page, they have an option to check the status of the application.

- An applicant will then be required to choose the application type (New PAN/updated information) and provide a few details including the 15 digit acknowledgement number, his/her full name and date of birth.

- On successfully providing the necessary information, he/she will be directed to a page that shows the current status of the application.

Note: Online tracking of a PAN application is possible only 24 hours after an application is submitted online.

Before I have discussed the uti pan card status by name and date of birth. Now let’s see how to check uti pan card status by acknowledgement no.

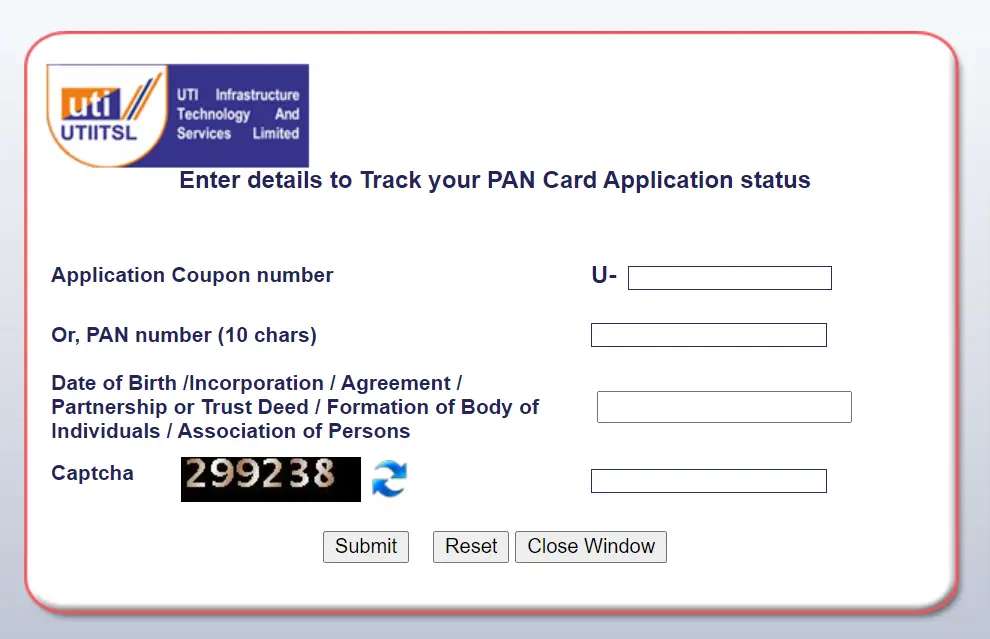

Check Your UTI PAN Application Status

You must have your application number in order to track your PAN card application status. The application number can be noted from your application form. To track your PAN Card status, you can follow the steps below:

- Access the UTIITSL’s PAN Online Portal.

- Select “Track PAN Card Application Status”.

- Select “Click here to check the status online”.

- Enter your Application coupon number.

- Click on submit to find out your application status.

Here I will conclude the topic –

- What is PAN

- Track PAN Card application status online

- How to check status of pan card

- Check UTI pan card status by name and date of birth

To apply for a new PAN Card or/and Changes or Correction in PAN data –

Go to the following link to fill the Application Form online:

https://www.myutiitsl.com/PAN_ONLINE/CSFPANApp

Conclusion: Know your pan status

It is quite easy to track the status of a PAN card application. When you apply for a PAN card or update/correct misinformation on your PAN card, you receive an acknowledgment number. You can use the acknowledgment number to track the status of your new application for a PAN card or to reprint your PAN card correction.

When you apply for a PAN Card, it will arrive in the mail. It takes about 15 days, which is obviously a long time.

If you need to know your pan status before the 15-day deadline, you can do so easily online at the official websites of UTI or NSDL. When you apply for a PAN Card, you will be given a 15-digit acknowledgement number.

After 7 days of applying for a PAN Card through NSDL or UTI, you can do pan cardtrack at the UTI Portal or the NSDL Portal. You can check the status of your PAN card in three ways: online, SMS, and phone call.

FAQs

Q1: Why my PAN application status is not showing?

A1: There could be a few reasons why your PAN application status is not showing. The most common reason is that your application has not been processed yet. It can take up to 15 days for your application to be processed. If it has been more than 15 days and your application status is still not showing, you can contact the PAN issuing authority.

Q2: How many days will it take to get PAN card status?

A2: It can take up to 15 days to get your PAN card status.

Q3: How can I know my PAN card is approved or not?

A3: You can check the status of your PAN card application online using your name, date of birth, or acknowledgment number. If your application status is Approved, then your PAN card has been approved.

Q4: What happens after online PAN application?

A4: After you submit your online PAN application, it will be processed by the PAN issuing authority. Once your application has been processed, you will be able to check the status of your application online. If your application is approved, you will receive your PAN card in the mail.

Q5: Can I get a PAN card in 2 days?

A5: No, it is not possible to get a PAN card in 2 days. The processing time for a PAN card application is up to 15 days.

Q6: How many hours to get instant PAN card?

A6: There is no such thing as an instant PAN card. The processing time for a PAN card application is up to 15 days.

DazzDeals

I am really happy to say that your post is pretty awesome as I am a regular online shopper and coupons are much needed for me. Hope to see more of your articles in the future on this topic

AKSHAY MUNIYA

Mobile number update karna

Vijay chanpa

Surajkaradi Dwaraka m

Ashok karnal katare

Mobail nambar cheng

To aadhar link