In this article, we will talk about how you can get a road tax refund. Relocating to a new city along with family and vehicle is a tedious task. Registering a vehicle in a new state is a complex process, especially if you are already transferring to a new state.

You cannot avoid registering your vehicle in a new state, but you can claim a road tax refund from the previous state’s RTO. Road tax is a tax that you pay periodically on motor vehicles for using public roads. The central and state governments, as well as local bodies, impose road tax in India.

Generally, keeping the complexity and the time exhaustive processes of the RTO in mind people are discouraged to get their road tax refund. There are many instances where people have moved from one state to another without getting the road tax refund to the old RTO and are subjected to double taxation. In fact, many are not even aware that there is a process via which previous road tax paid can be reclaimed.

So if you are amongst the group of vehicle-owners who have faced a similar dilemma. Here are the details you should know to get your old road tax refund after registering your vehicle in a new state:

An individual can claim the lifetime road tax refund paid to the previous state’s RTO only after paying lifetime tax and registering the vehicle with the new state’s transport department. The state entry tax also needs to be paid in addition to the lifetime tax.

Only after registering your vehicle with the new RTO in a new state, you are eligible to file a request to reclaim a lifetime road tax refund paid to the previous state.

Road tax refund

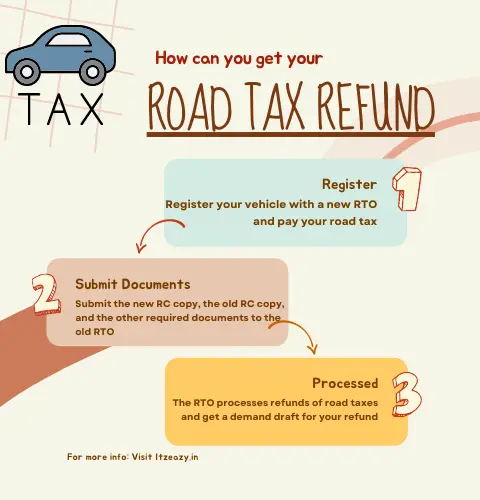

Here is how to get road tax refund

- Register your vehicle with a new RTO and pay your road tax

- Submit the new RC copy, the old RC copy, and the other required documents to the old RTO

- The RTO processes refunds of road taxes

- Get a demand draft for your refund

Which state has the Highest Tax on Petrol?

RC transfer fees for vehicle in India

NOC certificate online download

Documents required for tax refund:

Here are some of the documents that you might require while claiming your road tax refund

- Notarized copy of the new smart card and original or notarized copy of old smart card (as available)

- An imprint of car chassis

- NOC of state transfer (photocopy)

- Copy of new insurance and PUC

- Photocopy of receipt of new road tax paid

- Receipt of road tax paid previously in the first state where vehicle was registered

- RTO form DT, RTO Form 16 as the application for tax refund

- New address proof as evidence of migration along with ID proof

- Request letter for refund along with bank account number/address on which cheque needs to be sent

FAQs

Q1: How can I avoid RTO tax?

A1: You cannot avoid RTO tax. It is a mandatory tax that must be paid to register and use a motor vehicle in India.

Q2: How do I claim my TCS refund on my car?

A2: To claim your TCS refund on your car, you must file a return with the Income Tax Department. You can do this online or by submitting a physical form. You will need to provide documentation of the TCS that was paid, such as the invoice from the car dealership.

Q3: What happens if I don't pay road tax in India?

A3: If you don't pay road tax in India, you may be fined, your driver's license may be suspended, or your vehicle may be impounded.

Q4: Who pays road tax in India?

A4: The owner of a motor vehicle in India is responsible for paying road tax.

Q5: What is the purpose of collecting road tax?

A5: Road tax is collected to fund the construction and maintenance of roads.

CHANDRASEKHAR

I have recently transfered my MH-03 numbered SUV to AP and paide the full tax.

Can you get the tax refund from Mumbai RTO?