Wondering how to do correction in pan card UTI? If you have any issues with your PAN card and need to fix them. Making changes to your PAN card can be difficult at times if you do not have the correct procedures and documents for correcting pan card information. Don’t worry, I’m here to assist you by simplifying the process. For PAN Card correction, both online and offline methods are available. Here is a step-by-step guide for how to do Pan Card Correction? (how to correction pan card uti)

Here I will discuss How to do pan card correction, the documents for pan card correction In addition, how to fill out fill the form for pan card correction online. So, let’s begin with how to correction pan card uti

Let’s take a look at how you can fill out the form for pan card correction. Also, how to do pan card correction.

Documents for Pan Card Correction

As you know, documents are required for carrying out any such govt procedures. So, in order to make changes to your PAN Card, you must be aware of the necessary documents. So I have compiled a list of documents for pan card correction that you must include with your application for a PAN card correction.

- ID proof

- Address Proof

- Date of Birth proof

- Proof of PAN

- Supporting document for correction/ change in PAN card

- 2 passport size photograph

I’ll discuss how to do pan card correction and how to fill out the form for pan card correction. So read on to know how to correction pan card uti.

Before delving into the topic of how to do pan card correction and fill out the form for pan card correction and how to correction pan card UTI. Let’s look at some of the supporting documents for pan card correction.

Supporting document required for changes in PAN data

You have just learned what documents are required for the procedure of how to correction pan card uti. Along with those you need some supporting documents as well. Here is the list of supporting documents for pan card correction.

Document acceptable for change of name/father’s name

Married ladies – change of name on account of marriage

– Marriage certificate

– Marriage invitation card

– Copy of passport showing husband’s name

– Publication of name change in the official gazette

– Certificate issued by a Gazetted officer (only for change in applicant’s name)

Individual applicants other than married ladies

– Publication of name change in the official gazette or

– Certificate issued by a Gazetted officer (only for change in applicant’s name)

Companies Name Change

– ROC’s certificate for the name change

Firms / Limited Liability Partnerships

– Revised partnership deed

– Registrar of Firm/LLP’s certificate for a name change

AOP/Trust/BOI/AJP/LOCAL authority

– Revised Deed/ Agreement

– Revised registration certificate

That concludes the documents for pan card correction. Without further ado, I’ll explain how to do pan card correction and how to fill out the form for pan card correction. How to correction pan card uti?

How to do pan card correction online

The types of corrections or changes that can be made are a name change, year of birth, correction to the address or correction in the father’s name. Let’s discuss the procedure for how to correction pan card uti.

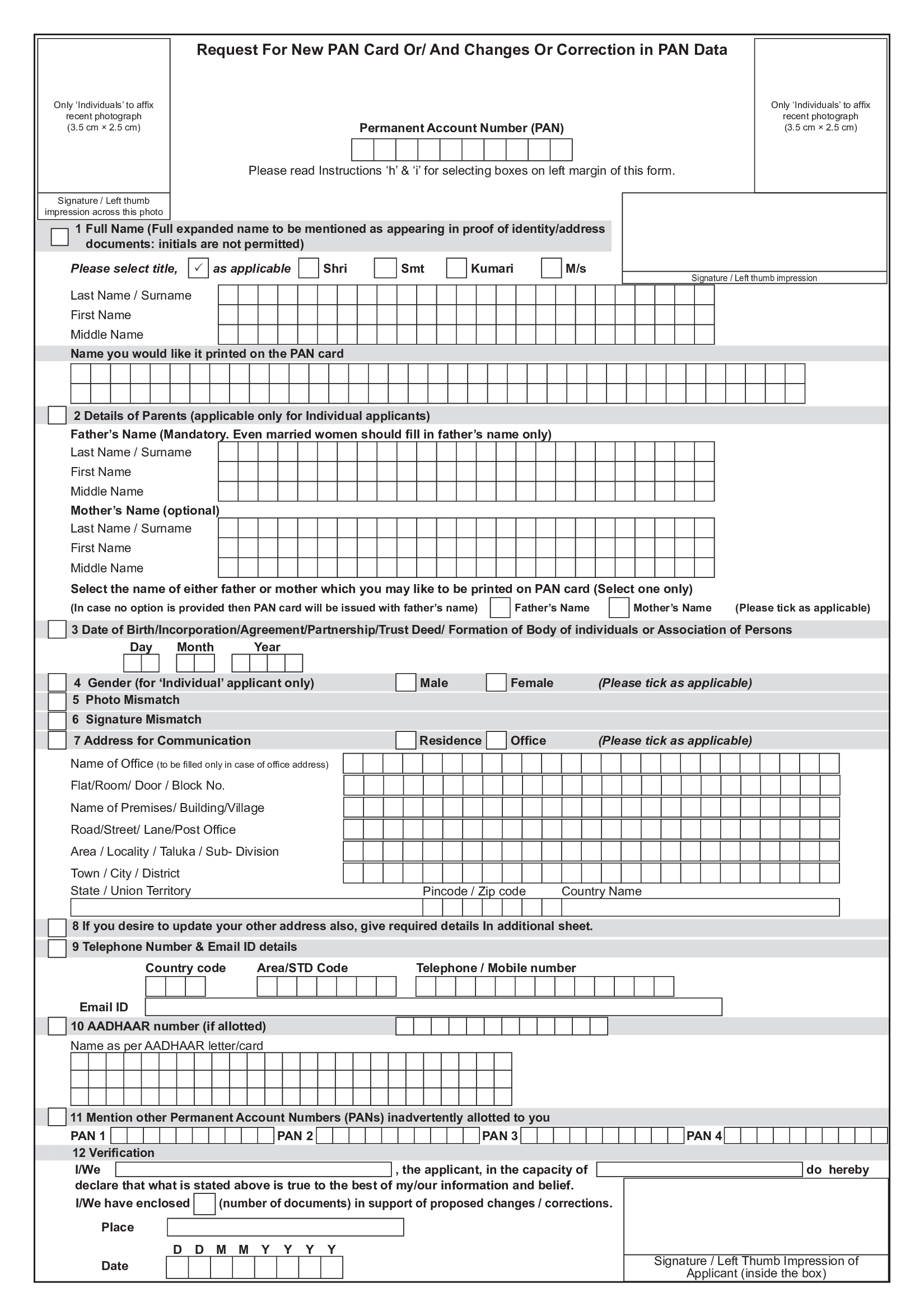

How to do pan card correction? Fill the form for pan card correction online by following these 6 steps: Here is the form for pan card correction, you can download it from here

How to Correct Pan Card UTI

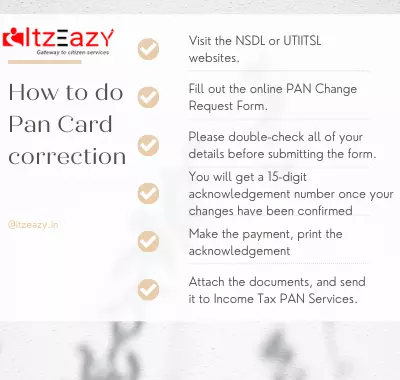

So, here I have simplified the procedure for how to do Pan Card Correction. These are the simple steps for how to correction pan card uti:

- Go to the NSDL website and click on “Online Application for Changes Or Correction in PAN Data (PAN Change Request Form)”.

- You will be directed to another page that will give you details regarding online application, payments, acknowledgement, mode of submission of documents, documents for pan card correction, etc. Scroll down the page and select the appropriate applicant category. Then select the “Select” option.

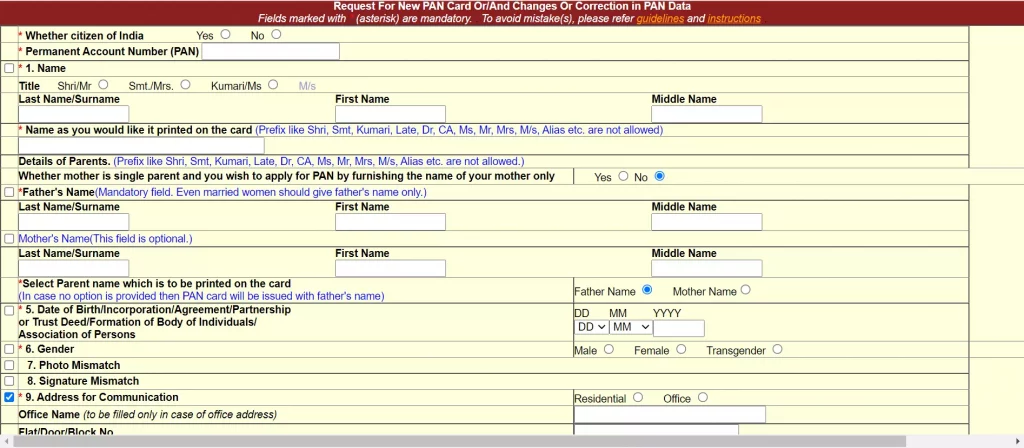

- You will see a form labelled “Request For New PAN Card Or/And Changes Or Corrections In PAN Data.” Fill in the form’s details and make any necessary changes.

- When you have finished filing the necessary details/changes/corrections, click the submit button.

- You will be given an acknowledgement slip.

- Next, choose either online or offline payment to pay the amounts of 110 (for an address in India) and 1,020. (for other addresses). Payment can be made only by credit/debit card and demand draught made payable to ‘NSDL – PAN’ in Mumbai.

- That’s how to do pan card correction online

However, making an online payment by using a credit card/debit card will attract an additional charge of up to 2% (plus applicable taxes) of the application fee by the bank for providing a gateway facility. Also, any payment made using a net banking facility will lead to an additional surcharge of 4 % + GST for the payment gateway facility.

If you chose the offline payment mode option for pan card correction, send the DD to NSDL. It is essential to mention your name and acknowledgement number on the reverse side of the DD.

In the final step of how to correction pan card uti, you are required to take a print-out of the acknowledgement slip, which needs to be signed. Also, attach-

- Photographs

- Proof of existing PAN

- Proof of Identity

- Address proof

- Certificate of DOB

- PAN card form for correction

Send these documents for pan card correction with acknowledgement slip to ‘NSDL e-Governance Infrastructure Limited, 5th floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411016’.

On receiving your payment, acknowledgement and the necessary documents, NSDL will process your application for how to correction pan card uti.

That’s all about how to do correction in pan card via UTI

How to apply for a duplicate PAN card

FAQs

Q1: What documents are required for PAN card correction?

A1: PAN card, proof of identity, address, date of birth, and supporting document for correction.

Q2: How can I change my name in PAN card without proof?

A2: You cannot change your name in PAN card without proof.

Q3: Is Aadhaar card enough for PAN card?

3: Yes, Aadhaar card is enough for PAN card.

Q4: What documents required for PAN card father name correction?

A4: PAN card, proof of identity, address, date of birth, and father's name correction document.

Q5: How much is PAN card correction?

A5: Rs. 110 for Indian address, Rs. 1,020 for foreign address.

Q6: How many rupees for PAN card correction?

A6: Rs. 110 for Indian address, Rs. 1,020 for foreign address.

SINGARIGARI HARISH

phone number change